Download Transaction Details

Overview

This article explains how to download transaction details of a summary journal entry.

The Invoice Adjustment transaction is deprecated on Production.

Download Transaction Details

You can download transaction details from the journal entry page or the journal run page. The download link appears when the journal entry status is "Created".

If there are more are than 1,000 transactions in a journal entry, the download processes the transactions asynchronously and downloads on completion. For journal entry with less the 1,000 transactions, the download occurs in real-time.

If you want to download or export a large CSV file, Zuora recommends you to use text editors other than Microsoft Excel to open the file. The maximum row number that Excel supports is 1,048,576.

Download from the Journal Run Page

Navigation to Finance > Journal Run. Click the journal run number to access the journal run page. Click [download] from a journal entry.

Download from an Accounting Period

Navigation to Finance > Accounting Periods and select an accounting period. Select the Summary Journal Entries tab. Click [download] from journal entry.

Export CSV File Naming Convention

JEExport_[Accounting Period Name]_[Transaction Type Included]_YYYYMMDDHHMMSS.csv

For example, JEExport_Apr14_Revenue-Event-Item_20140731141750.csv represents a journal entry export for the April 2014 accounting period that includes transactions for revenue event items. The CSV file was created on July 31, 2014 at 14:17:50 (military time).

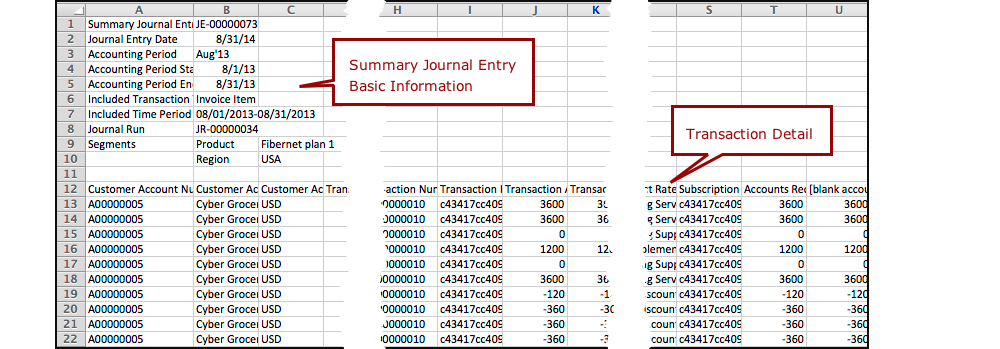

Transaction Details Export

The following is an excerpt from an exported transaction details CSV file of invoice items for the August 2013 accounting period.

Download Sort Order

Transactions are downloaded in the order listed.

| All Transactions, except for Revenue |

|

|---|---|

| Revenue Event Item Transactions |

|

Transaction Detail Columns

Transaction Subtypes

Transaction subtypes further qualify transactions. Transaction types for billing, cash, and credit balance transactions have a set of transaction subtypes. For example, an invoice transaction can be a charge, discount, prepayment, or tax.

| Transaction Type | Transaction Subtype |

|---|---|

|

Invoice Item |

|

| Taxation Item | None. |

|

Invoice Item Adjustment |

|

|

Invoice Item Adjustment Tax |

|

|

Invoice Adjustment |

|

|

Payment |

|

|

Refund |

|

|

Credit Balance Refund (electronic or external) |

|

|

Credit Balance Payment (electronic or external) |

|

|

Credit Balance (applied to invoice) |

|

|

Credit Balance (transferred from invoice) |

|

|

Revenue Item |

None. See the table at the end of this article for more information. |

Associated Transaction Types

Certain transaction types, such as invoice item adjustments or refunds, have a one-to-one relationship with another transaction type. The following table show how certain transaction types map to an associated transaction type.

Each associated transaction type has a corresponding associated transaction subtype. These subtypes are the same as those documented in the previous Transaction Subtypes table. For example, the associated transaction subtypes for Invoice Item Adjustment are Credit and Charge.

| Transaction Type | Associated Transaction Type | |||||

|---|---|---|---|---|---|---|

| Invoice | Invoice Item | Invoice Payment | Payment | Refund | Taxation Item | |

| Credit Balance (applied to invoice) |  |

|||||

| Credit Balance (transferred From invoice) |  |

|||||

| Credit Balance (electronic payment) |  |

|||||

| Credit Balance (external payment) |  |

|||||

| Credit Balance (electronic refund) |  |

|||||

| Credit Balance (external refund) |  |

|||||

| Invoice Adjustment |  |

|||||

| Invoice Item Adjustment |  |

|||||

| Invoice Item Adjustment (tax) |  |

|||||

| Payment (electronic) |  |

|||||

| Payment (external) |  |

|||||

| Refund (electronic) |  |

|||||

| Refund (external) |  |

|||||

| Tax |  |

|||||

The following table lists the transaction types that are only available if you enable the Invoice Settlement feature and Invoice Item Settlement feature. It also shows the corresponding transaction subtype, associated transaction types, and container transaction types.

Each associated transaction type or container transaction type has a corresponding associated transaction subtype or container transaction subtype. These subtypes are the same as those documented in the previous Transaction Subtypes table.

| Transaction Type | Transaction Subtype | Associated Transaction Type | Container Transaction Type |

|---|---|---|---|

|

If you enable the Invoice Settlement feature, Debit Memo Item, Credit Memo Item, and Credit Memo Application Item are available, Payment and Refund will be replaced by Payment Application and Refund Application. The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant. |

|||

| Debit Memo Item | Charge | None | Debit Memo |

| Tax | None | Debit Memo | |

| Credit Memo Item | Charge | None | Credit Memo |

| Tax | None | Credit Memo | |

| Discount | None | Credit Memo | |

| Credit Memo Application Item |

On-Account to Invoice Item |

Invoice Item | Credit Memo |

| On-Account to Invoice Taxation Item | Taxation Item | Credit Memo | |

| On-Account to Debit Memo Item | Debit Memo Item | Credit Memo | |

| On-Account to Debit Memo Taxation Item | Debit Memo Item | Credit Memo | |

| Invoice Item Reversal | Invoice Item | Credit Memo | |

| Invoice Taxation Item-Reversal | Taxation Item | Credit Memo | |

| Debit Memo Item Reversal | Debit Memo Item | Credit Memo | |

| Debit Memo Taxation Item Reversal | Debit Memo Item | Credit Memo | |

| Payment Application |

Invoice (It means payment creation and application apply to the invoice.) |

Invoice | Payment |

|

Invoice Reversal (It means when a payment is unapplied from an invoice, the transaction sub-type will reflect Invoice reversal.) |

Invoice | Payment | |

|

Unapplied (Payment created as an unapplied payment.) |

None | Payment | |

|

Transferred (It means payment owner transferred (original owner)) |

None | Payment | |

|

Transferred to Unapplied (It means payment owner transferred (new owner)) |

None | Payment | |

|

Unapplied to Invoice (It means payment is applied to the invoice.) |

Invoice | Payment | |

|

Debit Memo (It means payment is created and applied to the debit memo.) |

Debit Memo | Payment | |

|

Debit Memo Reversal (It means when a payment is unapplied from a debit memo, the transaction sub-type will reflect debit memo reversal.) |

Debit Memo | Payment | |

|

Unapplied to Debit Memo (It means payment is applied to a debit memo.) |

Debit Memo | Payment | |

| Refund Application |

Unapplied Payment |

Unapplied Payment | Refund |

| Credit Memo | Credit Memo | Refund | |

|

If you enable both the Invoice Settlement feature and the Invoice Item Settlement feature, Payment and Refund will be replaced by Payment Application Item and Refund Application Item. The Invoice Item Settlement feature is only available if you have Invoice Settlement enabled. The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. |

|||

| Payment Application Item |

Unapplied (Payment created as an unapplied payment.) |

None | Payment |

|

Invoice Item (It means payment creation and applies to the invoice.) |

Invoice Item | Payment | |

|

Taxation Item (Payment application to tax.) |

Taxation Item | Payment | |

|

Debit Memo Item (It means payment is created and applied to the debit memo item.) |

Debit Memo Item | Payment | |

|

Invoice Item Reversal (It means when a payment is unapplied from an invoice item, the transaction sub-type will reflect Invoice reversal.) |

Invoice Item | Payment | |

| Taxation Item Reversal | Taxation Item | Payment | |

|

Unapplied to Invoice Item (It means applying the Unapplied balance of payment to the Invoice Item.) |

Invoice Item | Payment | |

|

Unapplied to Taxation Item (It means applying the Unapplied balance of payment to the Taxation Item.) |

Taxation Item | Payment | |

|

Debit Memo Item Reversal (It means when a payment is unapplied from a debit memo item, the transaction sub-type will reflect debit memo reversal) |

Debit Memo Item | Payment | |

| Debit Memo Taxation Item Reversal | Debit Memo Item | Payment | |

|

Unapplied to Debit Memo Item (It means applying the Unapplied balance of payment to the Debit Memo Item) |

Debit Memo Item | Payment | |

|

Unapplied to Debit Memo Taxation Item (It means applying the Unapplied balance of payment to the Debit Memo Taxation Item.) |

Debit Memo Item | Payment | |

| Refund Application Item | Credit Memo Item | Credit Memo Item | Refund |

| Unapplied Payment | Unapplied Payment | Refund | |

Transaction Details for Revenue Event Items

The set of data exported for a revenue event item differs from all other transaction exports. Key differences include:

| Column | Revenue Event Item |

|---|---|

| Transaction Type | The transaction that created the revenue event item. |

| Transaction Subtype | The transaction subtype of the transaction that created the revenue event item. |

The Revenue event item download includes data related to revenue schedules and additional revenue event details.