Avalara taxes in invoice item adjustments

Adjusting an invoice item with a processing type of Charge or Discount will result in a charge invoice item adjustment. The Avalara Integration calculates taxes for charge invoice item adjustments through the Zuora UI and SOAP API. When you create charge invoice item adjustments in the Zuora UI, tax values are calculated by Avalara synchronously. Zuora records these taxes as invoice item adjustments. You can view these tax invoice item adjustments from the Zuora adjustment list after the charge invoice item adjustments are processed. For each charge invoice item adjustment, Zuora creates a corresponding invoice item adjustment for each tax item returned from Avalara.

When Avalara Integration calculates taxes for charge invoice item adjustments, Avalara might return an extra tax item with a 0% tax rate. Zuora validates all the tax items when creating invoice item adjustments, but this extra tax item is ignored during the tax item validation.

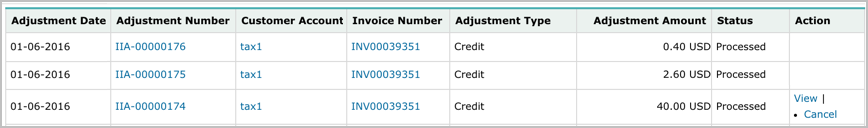

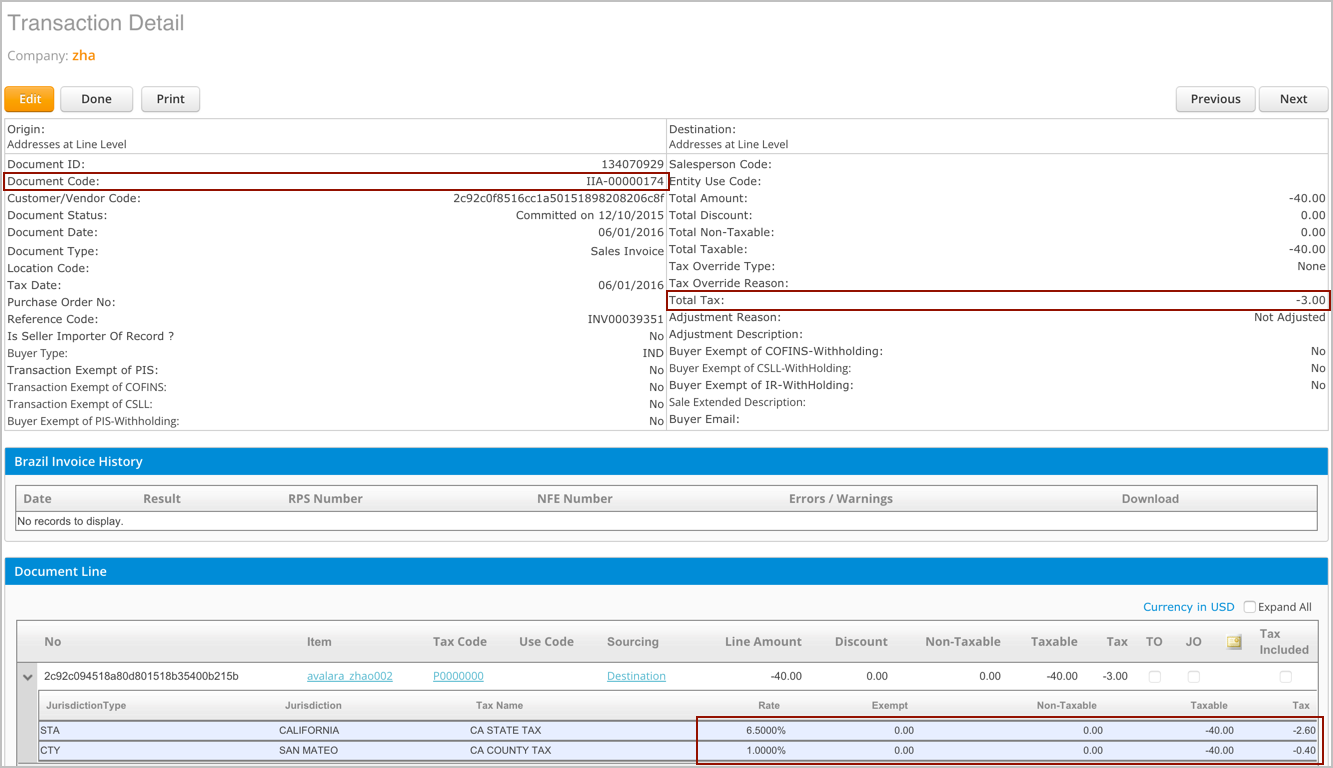

The following figure gives an example of the credit-type charge invoice item adjustment (IIA-00000174) and its tax invoice item adjustments (IIA-00000175 and IIA-00000176).

You can also view the transaction details and tax items in Avalara.

Enablement

Before you can access this feature, complete the following steps to enable it:

- Ensure that Invoice Settlement is disabled and Direct Avalara Integration is enabled. To enable Direct Avalara Integration, submit a request at Zuora Global Support.

- Enable this feature in Billing Rules settings:

- Click your username at the upper right and navigate to Settings > Billing > Define Billing Rules.

- On the Billing Rules page, click edit, select Yes from the Use Avalara to calculate taxes for invoice item adjustments? List, and click save.

Limitations

The limitations on calculating tax for charge invoice item adjustments are as follows:

- After this feature is enabled, Avalara controls all tax calculations and Zuora does not adjust tax line items. If you want to adjust tax line items in Zuora, disable this feature by setting Use Avalara to calculate taxes for invoice item adjustments to No in Billing Rules, create invoice item adjustments to adjust tax line items, and then enable this feature again.

- When creating charge invoice item adjustments in a batch call, Zuora recommends you have up to five charge invoice item adjustments. A timeout error can occur if the communication between Zuora and Avalara takes more than two minutes.

- When you use the SOAP API to create charge invoice item adjustments, Zuora does not support using the useSingleTransaction field on the CallOption object.

Cancel tax invoice item adjustments

Avalara controls all tax calculations. When you create charge invoice item adjustments in Zuora, tax invoice item adjustments are created automatically and are tied to their charge invoice item adjustments. To cancel a tax invoice item adjustment, you must cancel the corresponding charge invoice item adjustment.