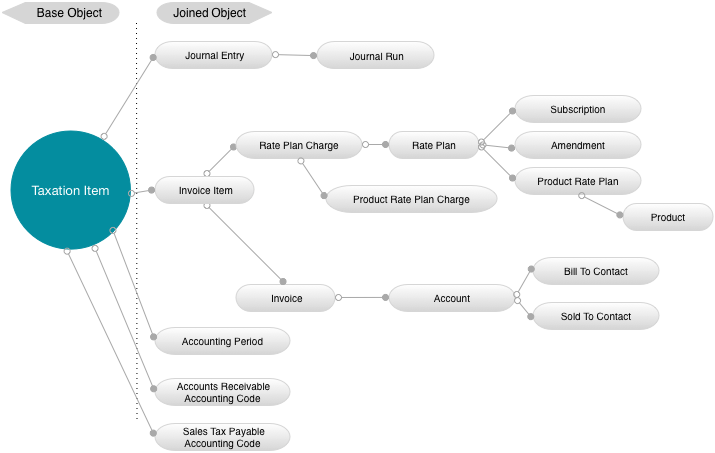

Taxation Item Data Source

Use this data source to export taxation information. This data source includes information on Account, Product, Subscription, Charges, and RatePlans. Each row represents one line of taxation record on invoice item.

Base Object Description

| Object | Description |

|---|---|

| Taxation Item |

This is the base object for the Taxation Item Data Source Export. Contains the following fields:

|

Related Zuora Objects

| Object | Description |

|---|---|

|

Account |

The customer account and corresponding details. |

|

Accounting Period |

|

|

Accounts Receivable Accounting Code |

|

|

Amendment |

The amendment that is tied to the invoice item, if applicable. |

|

Bill To Contact |

The contact of the entity/person to whom you bill for your product or service. |

| Entity |

The entity that the data relates to. Part of the Multi-entity feature. Contains the following fields:

|

|

Invoice |

Invoice that contains the invoice item. |

|

Invoice |

Invoice that taxation was applied to. |

|

Invoice Item |

Invoice item that the taxation item was applied to. |

|

Journal Entry |

Represents a Zuora transaction recorded as a debit and credit. Includes the following fields:

This object is available on this data source only when Zuora Finance is enabled on your tenant. |

|

Journal Run |

Automated process for creating journal entries from Zuora transactions. Includes the following fields:

This object is available on this data source only when Zuora Finance is enabled on your tenant. |

|

Product |

The product related to the taxation. |

|

Product Rate Plan |

The pricing plan (in the Product Catalog) related to the taxation. |

|

Product Rate Plan Charge |

The charge (in the Product Catalog) that is related to the taxation. |

|

Rate Plan |

The pricing plan (for the subscription) that is related to the taxation. |

|

Rate Plan Charge |

The charge (for the subscription) that is related to the taxation. |

|

Sales Tax Payable Accounting Code |

|

|

Sold To Contact |

The contact of the entity/person to whom your product or service is sold. |

| Taxation Item FX Data |

Contains Home Currency and Reporting Currency information. |

|

Subscription |

The subscription the invoice item belongs to. |

| Taxable Item Snapshot |