Flexible Tax Mapping

When supported tax apps and vendors complete tax calculations and send back the results, Zuora stores the returned values in the database with a built-in rule for mapping fields. With Flexible Tax Mapping, you can override the built-in mapping rule to select and store the data that best suits your business needs.

Customize field mappings

Before customizing field mappings, purchase the tax app you want to use from the Marketplace, install it, and access it in your Zuora tenant. See Configurable tax app for information about purchasing an app, installing it, and accessing it in Zuora Billing.

To customize field mappings, navigate to Engine Setting > Field Mappings. Click Add Mapping and specify values for Field Name and Field Path.

Mapping fields in tax engines

The following section illustrates what fields can be mapped and their respective mappings in each tax engine.

Note that we only support field mapping for the Taxation Item object.

Vertex O Series Tax Connector app

The following table lists the fields that can be mapped and specified in Field Name. Information about how to figure out the path to fetch a value from Vertex O Series Tax Connector app (Vertex) is also provided.

| Description | |

|---|---|

| Field name |

Field on the Zuora TaxationItem object to store a value. The following fields are supported:

After activating invoice tax fields through the Zuora UI, you can override the custom fields that are sent in the billing request, in addition to the listed fields. These custom fields will be reflected in the taxation response, ending with suffix __c (double underscore c). For more information about managing custom fields via Zuora UI, see Manage custom fields. |

| Field path |

Path to fetch a value from Vertex’s response. Only the fields in the A typical response from Vertex is in XML format (<Element attribute></Element>).

|

Example

A typical response from Vertex is as follows:

<Taxes taxResult="TAXABLE" taxType="SELLER_USE" situs="DESTINATION" taxCollectedFromParty="BUYER" taxStructure="SINGLE_RATE">

<Jurisdiction jurisdictionLevel="DISTRICT" jurisdictionId="96933"><![CDATA[RETAIL TRANSACTIONS AND USE TAX (SMGT)]]></Jurisdiction>

<CalculatedTax>10.0</CalculatedTax>

<EffectiveRate>0.005</EffectiveRate>

<Taxable>2000.0</Taxable>

<Imposition impositionId="1">Local Sales and Use Tax</Imposition>

<ImpositionType impositionTypeId="1">General Sales and Use Tax</ImpositionType>

<TaxRuleId>496343</TaxRuleId>

</Taxes>

- To map Zuora’s

namefield with Vertex’simpositionIdattribute, the field path isImposition, impositionId, and the value stored is1 - To map Zuora’s

namefield with Vertex’sImpositionelement, the field path isImposition, __content__, and the value stored isLocal Sales and Use Tax - To store no value on Zuora’s

namefield, the field path isblank

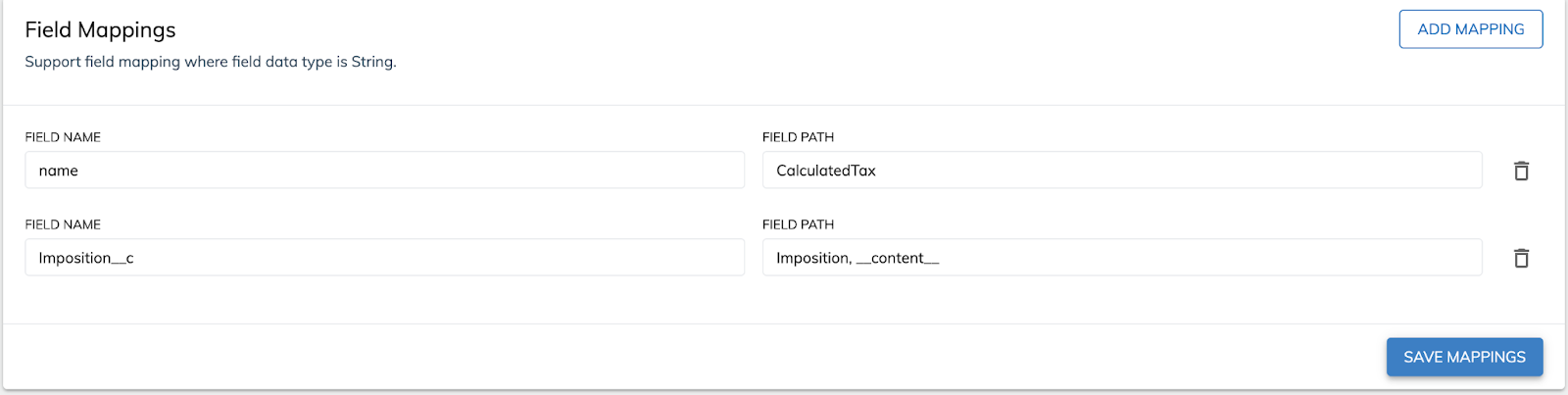

The following screenshot illustrates how to specify the values for Field Name and Field Path in the Zuora UI:

- When the field in the response does not have optional attributes such as

<CalculatedTax>10.0</CalculatedTax>:- Set Field Name to

name - Set Field Path to the name of the field in the Vertex response field, which is

CalculatedTaxin this case

- Set Field Name to

- When the field in the response has optional attributes such as

<Imposition impositionId="1">Local Sales and Use Tax</Imposition>:- Set Field Name to a custom field, which is

Imposition__cin this case - Set Field Path to

Imposition, __content__

- Set Field Name to a custom field, which is

Vertex Advantage Tax Connector app

The following table lists the fields that can be mapped and specified in Field Name. Information about how to figure out the path to fetch a value from Vertex Advantage Tax Connector app (Taxamo) is also provided.

| Description | |

|---|---|

| Field name |

Field on the Zuora TaxationItem object to store a value. The following fields are supported:

After activating invoice tax fields through the Zuora UI, you can override the custom fields that are sent in the billing request, in addition to the listed fields. These custom fields will be reflected in the taxation response, ending with suffix __c (double underscore c). For more information about managing custom fields via Zuora UI, see Manage custom fields. |

| Field path |

Path to fetch a value from Taxamo’s response. Only the fields under the |

Example

A typical transaction_lines block from the Taxamo vendor response is as follows:

"transaction_lines": [

{

"description": "Live - Monthly",

"amount": 39.0,

"unit_price": 39.0,

"custom_fields": [

{

"key": "invoiceItemId",

"value": "8a28b56b8e554f76018e55f3cbaa3030"

},

{

"key": "taxCode",

"value": "VAT/GST"

},

{

"key": "taxMode",

"value": "0"

},

{

"key": "dbId",

"value": "50715533"

},

{

"key": "chargeId",

"value": "8a28828d68a2803f0168ab2e14ae1d2d"

},

{

"key": "documentId",

"value": "8a28b56b8e554f76018e55f3cb8c302c"

},

{

"key": "documentNumber",

"value": "INV01827680"

},

{

"key": "discountAmount",

"value": "0"

}

],

"tax_amount": 2.57,

"tax_deducted": false,

"tax_region": "US",

"cached_rate": false,

"tax_rate": 6.5897435898,

"additional_currencies": {

"tax": {

"amount": 39.0,

"tax_amount": 2.57,

"total_amount": 41.57

}

},

"tax_country_code": "US",

"line_key": "YIOeJbRhNhOhm1FU",

"custom_id": "8a28b56b8e554f76018e55f3cbaa3030",

"tax_name": "Texas Tax",

"tax_rate_checks": [

"CA-GST-enabled",

"CA-BC-PST-enabled",

"CA-SK-PST-enabled",

"CA-QC-QST-enabled"

],

"product_tax_code": "310104",

"line_num": 1,

"quantity": 1,

"total_amount": 41.57,

"tax_components": [

{

"revenue": 39.0,

"tax_amount": 1.95,

"city": "PLANO",

"tax_rate": 6.25,

"county": "COLLIN",

"tax_authority_name": "TEXAS",

"tax_authority_id": "35763",

"tax_name": "Sales and Use Tax",

"revenue_base": 31.2,

"calculated_tax_rate_used": true,

"percent_taxable": 0.8,

"jurisdiction_code": "35763",

"calculated_tax_rate": 5,

"state_code": "TX"

},

{

"revenue": 39.0,

"tax_amount": 0.31,

"city": "PLANO",

"tax_rate": 1,

"county": "COLLIN",

"tax_authority_name": "PLANO",

"tax_authority_id": "77891",

"tax_name": "Local Sales and Use Tax",

"revenue_base": 31.2,

"calculated_tax_rate_used": true,

"percent_taxable": 0.8,

"jurisdiction_code": "77891",

"calculated_tax_rate": 0.7948717949,

"state_code": "TX"

},

{

"revenue": 39.0,

"tax_amount": 0.31,

"city": "PLANO",

"tax_rate": 1,

"county": "COLLIN",

"tax_authority_name": "DALLAS METROPOLITAN TRANSIT AUTHORITY",

"tax_authority_id": "78120",

"tax_name": "Local Sales and Use Tax",

"revenue_base": 31.2,

"calculated_tax_rate_used": true,

"percent_taxable": 0.8,

"jurisdiction_code": "78120",

"calculated_tax_rate": 0.7948717949,

"state_code": "TX"

}

],

"tax_entity_name": "US",

"tax_supported": true

}

],

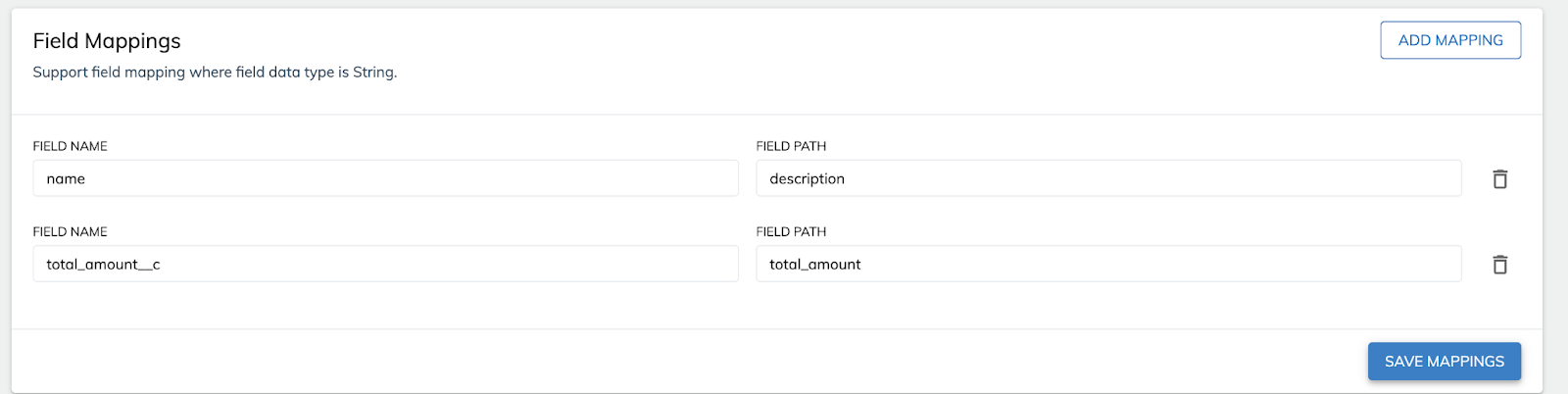

The following screenshot illustrates how to specify the values for Field Name and Field Path in the Zuora UI:

- Set Field Name to

name, and set Field Path todescription - Set Field Name to

total_amount__c(custom field), and set Field Path tototal_amount

Note that the preceding example is applicable to invoice. The response body of credit memo is different from the response body of invoice. The fields available for Field Path changes, while the format remains the same. See the following example.

{"refund_note_number"=>nil,

"tax_amount"=>0,

"total_amount"=>0,

"refunded_total_amount"=>57.82,

"refunded_tax_amount"=>8.82,

"warnings"=>[{"type"=>"refund-amount-too-high",

"message"=>"Provided amount to be refunded is too high, trimming."}]}

In addition to maintaining the current flexible fields mapping support, our system also offers the capability to map fields within the tax_components section of the vendor response, simplifying access through direct access as shown in the following image:

OneSource Determination app

The following table lists the fields that can be mapped and specified in Field Name. Information about how to figure out the path to fetch a value from OneSource Determination app (Sabrix) is also provided.

| Description | |

|---|---|

| Field name |

Field on the Zuora TaxationItem object to store a value. The following fields are supported:

After activating invoice tax fields through the Zuora UI, you can override the custom fields that are sent in the billing request, in addition to the listed fields. These custom fields will be reflected in the taxation response, ending with suffix __c (double underscore c). For more information about managing custom fields via Zuora UI, see Manage custom fields. |

| Field path |

Path to fetch a value from Sabrix’s response. Only the fields in the |

Example

A typical TAX block from the OneSource Determination vendor response is as follows:

<TAX>

<RULE_ORDER>9970</RULE_ORDER>

<TAXABLE_COUNTRY>US</TAXABLE_COUNTRY>

<TAXABLE_COUNTRY_NAME>UNITED STATES</TAXABLE_COUNTRY_NAME>

<TAXABLE_STATE>PUERTO RICO</TAXABLE_STATE>

<TAXABLE_COUNTY>PONCE</TAXABLE_COUNTY>

<TAXABLE_CITY>PONCE</TAXABLE_CITY>

<TAXABLE_POSTCODE>00780</TAXABLE_POSTCODE>

<TAX_RATE_CODE>CU</TAX_RATE_CODE>

<TAX_TYPE>CU</TAX_TYPE>

<ZONE_NAME>PUERTO RICO</ZONE_NAME>

<ZONE_LEVEL>State</ZONE_LEVEL>

<TAX_RATE>0.105</TAX_RATE>

<NATURE_OF_TAX>P</NATURE_OF_TAX>

<EU_TRANSACTION>false</EU_TRANSACTION>

<AUTHORITY_UUID>fec10be8-57e8-4ce8-81b5-3475f77a3031</AUTHORITY_UUID>

<AUTHORITY_CURRENCY_CODE>USD</AUTHORITY_CURRENCY_CODE>

<CURRENCY_CONVERSION>

<TAX_EXCHANGE_RATE_DATE>2022-08-09</TAX_EXCHANGE_RATE_DATE>

</CURRENCY_CONVERSION>

<EXEMPT_AMOUNT>

<DOCUMENT_AMOUNT>0.00</DOCUMENT_AMOUNT>

<UNROUNDED_DOCUMENT_AMOUNT>0.0000000000</UNROUNDED_DOCUMENT_AMOUNT>

<AUTHORITY_AMOUNT>0.00</AUTHORITY_AMOUNT>

<UNROUNDED_AUTHORITY_AMOUNT>0.0000000000</UNROUNDED_AUTHORITY_AMOUNT>

</EXEMPT_AMOUNT>

<GROSS_AMOUNT>

<AUTHORITY_AMOUNT>120.00</AUTHORITY_AMOUNT>

<UNROUNDED_AUTHORITY_AMOUNT>120.0000000000</UNROUNDED_AUTHORITY_AMOUNT>

</GROSS_AMOUNT>

</TAX>

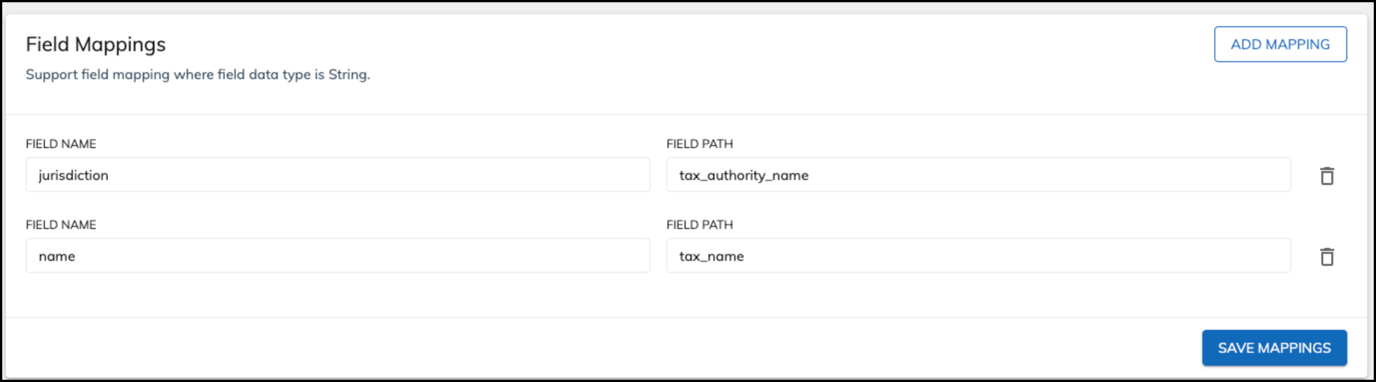

The following screenshot illustrates how to specify the values for Field Name and Field Path in the Zuora UI:

Assume that you want to map the field name with TAXABLE_COUNTRY_NAME and the custom field GrossAmount__c with UNROUNDED_AUTHORITY_AMOUNT, perform the following actions:

- Set Field Name to

name, and Field Path toTAXABLE_COUNTRY_NAME - Set Field Name to

GrossAmount__c, and Field Path toGROSS_AMOUNT, UNROUNDED_AUTHORITY_AMOUNT

AsUNROUNDED_AUTHORITY_AMOUNTis nested insideGROSS_AMOUNT, we follow the rule <outer element>, <nested element> to set Field Path - Set Field Path to

blankto store no value on thenamefield

Avalara AvaTax for Communication app

The following table lists the fields that can be mapped and specified in Field Name. Information about how to figure out the path to fetch a value from Avalara AvaTax for Communication app (AvalaraTelco) is also provided.

| Description | |

|---|---|

| Field name |

Field on the Zuora TaxationItem object to store a value. The following fields are supported:

After activating invoice tax fields through the Zuora UI, you can override the custom fields that are sent in the billing request, in addition to the listed fields. These custom fields will be reflected in the taxation response, ending with suffix __c (double underscore c). For more information about managing custom fields via Zuora UI, see Manage custom fields. |

| Field path |

Path to fetch a value from AvalaraTelco’s response. Only the fields in the |

Example

A typical txs block from the AvalaraTelco vendor response is as follows:

{

"inv": [

{

"doc": "CM00098111",

"itms": [

{

"ref": "8a28e9bd7de2b488017de48c907e2bdc",

"txs": [

{

"bill": true,

"cmpl": true,

"tm": 41.1,

"calc": 1,

"cat": "UTILITY USER TAXES",

"cid": 8,

"name": "Utility Users Tax",

"exm": 0,

"lns": 0,

"min": 0,

"pcd": 383700,

"rate": 0.04,

"sur": false,

"tax": 1.644,

"lvl": 3,

"tid": 16

},

{

"bill": true,

"cmpl": true,

"tm": 41.1,

"calc": 1,

"cat": "EXCISE TAXES",

"cid": 4,

"name": "Federal Excise Tax",

"exm": 0,

"lns": 0,

"min": 0,

"pcd": 0,

"rate": 0.03,

"sur": false,

"tax": 1.233,

"lvl": 0,

"tid": 6

}

]

},

{

"ref": "8a28e9bd7de2b488017de48c907d2bd9",

"txs": [

{

"bill": true,

"cmpl": true,

"tm": 20.13,

"calc": 1,

"cat": "UTILITY USER TAXES",

"cid": 8,

"name": "Utility Users Tax",

"exm": 0,

"lns": 0,

"min": 0,

"pcd": 383700,

"rate": 0.04,

"sur": false,

"tax": -0.8052,

"lvl": 3,

"tid": 16

},

{

"bill": true,

"cmpl": true,

"tm": 20.13,

"calc": 1,

"cat": "EXCISE TAXES",

"cid": 4,

"name": "Federal Excise Tax",

"exm": 0,

"lns": 0,

"min": 0,

"pcd": 0,

"rate": 0.03,

"sur": false,

"tax": -0.6039,

"lvl": 0,

"tid": 6

}

]

}

],

"incrf": {

"acct": "5408166",

"ccycd": "USD",

"ccydesc": "US Dollar"

}

}

]

}

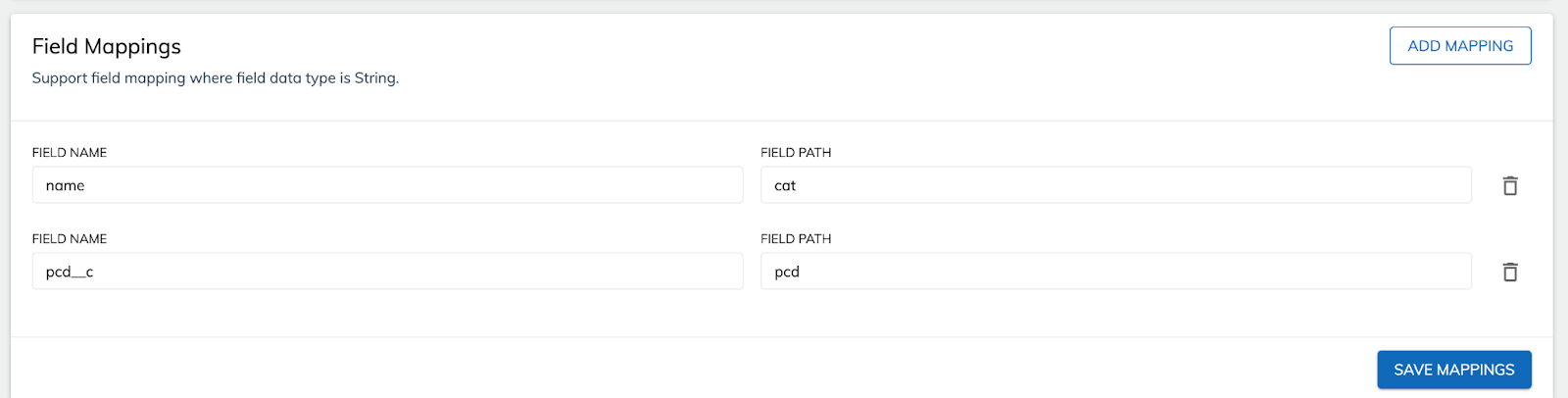

The following screenshot illustrates how to specify the values for Field Name and Field Path in the Zuora UI:

- Set Field Name to

name, and set Field Path tocat - Set Field Name to

pcd__c(custom field), and set Field Path topcd

Avalara AvaTax for Sales app

The following table lists the fields that can be mapped and specified in Field Name. Information about how to figure out the path to fetch a value from Avalara AvaTax for Sales app (AvaTax) is also provided.

| Description | |

|---|---|

| Field name |

Field on the Zuora TaxationItem object to store a value. The following fields are supported:

After activating invoice tax fields through the Zuora UI, you can override the custom fields that are sent in the billing request, in addition to the listed fields. These custom fields will be reflected in the taxation response, ending with suffix __c (double underscore c). For more information about managing custom fields via Zuora UI, see Manage custom fields. |

| Field path |

Path to fetch a value from AvaTax’s response. Only the fields in the |

Example

A typical details block from the AvaTax vendor response is as follows:

"lines": [

{

"id": 85013306890397,

"transactionId": 85013306890394,

"lineNumber": "8ad09c4b8282409a01828601458a5bd8",

"boundaryOverrideId": 0,

"customerUsageType": "",

"entityUseCode": "",

"description": "8ad09c4b8282409a01828601456a5bd7",

"destinationAddressId": 85013306890395,

"originAddressId": 85013306890395,

"discountAmount": 0,

"discountTypeId": 0,

"exemptAmount": 0,

"exemptCertId": 0,

"exemptNo": "",

"isItemTaxable": true,

"isSSTP": false,

"itemCode": "",

"lineAmount": 120,

"quantity": 1,

"ref1": "",

"ref2": "",

"reportingDate": "2022-08-09",

"revAccount": "",

"sourcing": "Destination",

"tax": 13.8,

"taxableAmount": 120,

"taxCalculated": 13.8,

"taxCode": "P0000000",

"taxCodeId": 8087,

"taxDate": "2022-08-09",

"taxEngine": "",

"taxOverrideType": "None",

"businessIdentificationNo": "",

"taxOverrideAmount": 0,

"taxOverrideReason": "",

"taxIncluded": false,

"details": [

{

"id": 85013306890400,

"transactionLineId": 85013306890397,

"transactionId": 85013306890394,

"addressId": 85013306890395,

"country": "US",

"region": "PR",

"countyFIPS": "",

"stateFIPS": "",

"exemptAmount": 0,

"exemptReasonId": 4,

"inState": true,

"jurisCode": "72",

"jurisName": "PUERTO RICO",

"jurisdictionId": 10190241,

"signatureCode": "CXFO",

"stateAssignedNo": "",

"jurisType": "STA",

"jurisdictionType": "State",

"nonTaxableAmount": 0,

"nonTaxableRuleId": 0,

"nonTaxableType": "RateRule",

"rate": 0.105,

"rateRuleId": 1359492,

"rateSourceId": 3,

"serCode": "",

"sourcing": "Destination",

"tax": 12.6,

"taxableAmount": 120,

"taxType": "Sales",

"taxSubTypeId": "S",

"taxTypeGroupId": "SalesAndUse",

"taxName": "PR STATE TAX",

"taxAuthorityTypeId": 45,

"taxRegionId": 2131047,

"taxCalculated": 12.6,

"taxOverride": 0,

"rateType": "General",

"rateTypeCode": "G",

"taxableUnits": 120,

"nonTaxableUnits": 0,

"exemptUnits": 0,

"unitOfBasis": "PerCurrencyUnit",

"isNonPassThru": false,

"isFee": false,

"reportingTaxableUnits": 120,

"reportingNonTaxableUnits": 0,

"reportingExemptUnits": 0,

"reportingTax": 12.6,

"reportingTaxCalculated": 12.6,

"liabilityType": "Seller"

}

],

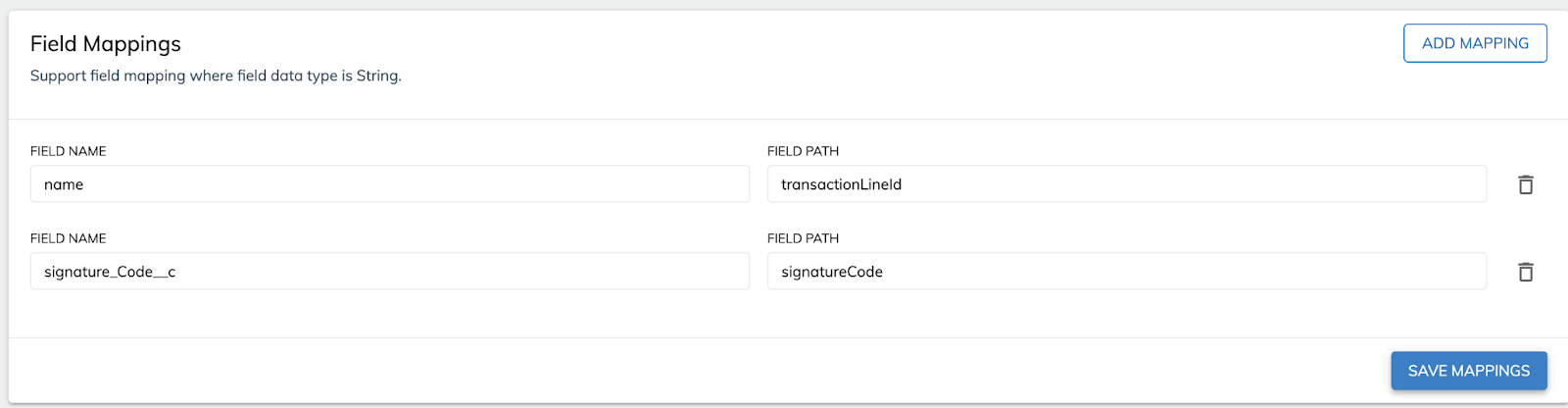

The following screenshot illustrates how to specify the values for Field Name and Field Path in the Zuora UI:

- Set Field Name to

name, and set Field Path totransactionLineId - Set Field Name to

signature_Code__c(custom field), and set Field Path tosignatureCode

CCH SureTax Connector app

The following table lists the fields that can be mapped and specified in Field Name. Information about how to figure out the path to fetch a value from CCH SureTax Connector app (SureTax) is also provided.

| Description | |

|---|---|

| Field name |

Field on the Zuora TaxationItem object to store a value. The following fields are supported:

After activating invoice tax fields through the Zuora UI, you can override the custom fields that are sent in the billing request, in addition to the listed fields. These custom fields will be reflected in the taxation response, ending with suffix __c (double underscore c). For more information about managing custom fields via Zuora UI, see Manage custom fields. |

| Field path |

Path to fetch a value from SureTax’s response. Only the fields in the |

Example

A typical TaxList block from the SureTax vendor response is as follows:

<TaxList>

<Tax>

<TaxTypeCode>051</TaxTypeCode>

<TaxTypeDesc>VAT</TaxTypeDesc>

<TaxAmount>20.84</TaxAmount>

<Revenue>83.36</Revenue>

<CountyName>UNKNOWN</CountyName><CityName />

<TaxRate>0.250000000000</TaxRate>

<PercentTaxable>1.000000</PercentTaxable>

<FeeRate>0</FeeRate>

<RevenueBase>83.36</RevenueBase>

<TaxOnTax>0</TaxOnTax>

<TaxAuthorityID>99999056</TaxAuthorityID>

<TaxAuthorityName>DENMARK</TaxAuthorityName><Juriscode />

</Tax>

</TaxList>

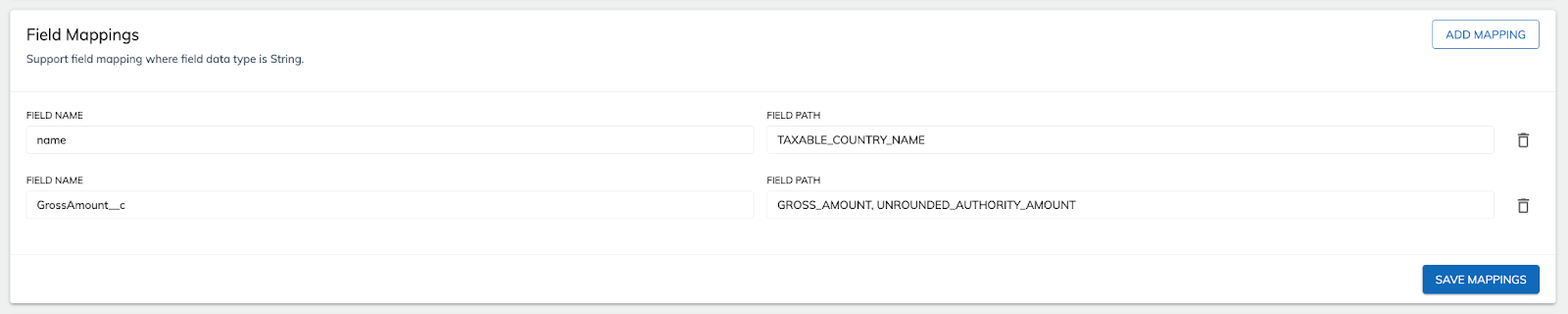

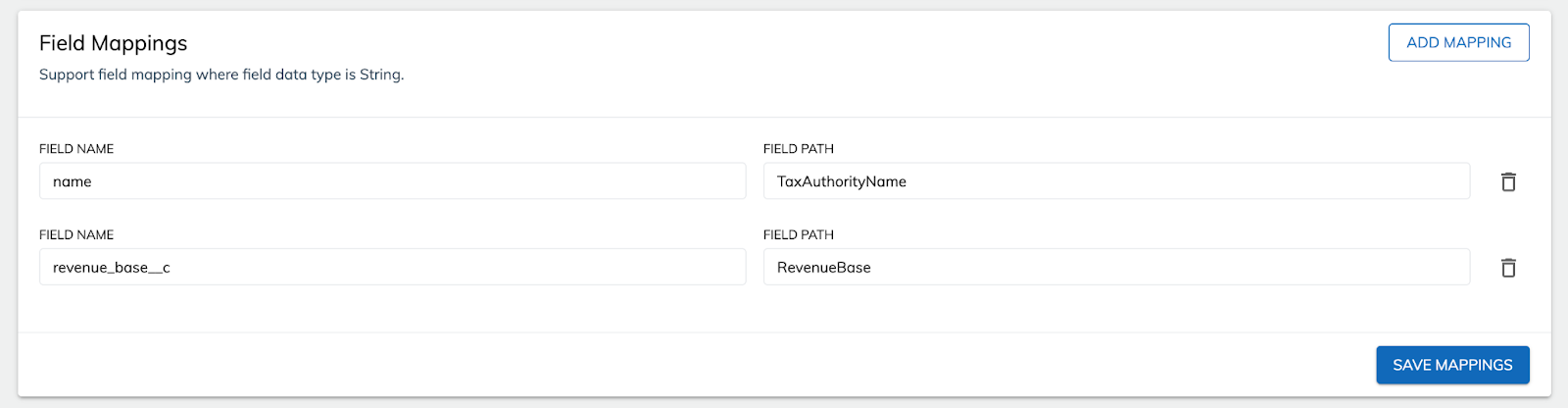

The following screenshot illustrates how to specify the values for Field Name and Field Path in the Zuora UI:

- Set Field Name to

name, and set Field Path toTaxAuthorityName - Set Field Name to

revenue_base__c(custom field), and set Field Path toRevenueBase