How do I migrate from deferred revenue reports to the new revenue recognition package?

For users of revenue recognition reports. Zuora's full-featured Revenue Recognition has replaced Deferred Revenue, Journal Entry, and Transaction Detail reports. These reports were great at helping businesses like yours with basic revenue recognition. These same businesses asked for a more advanced solution. We have answered that call with new Revenue Recognition capabilities.

Watch our webinar Getting Started with Revenue Recognition to learn all the details and about how easily you can transition to the new solution.

This article will help you determine if migrating to new Revenue Recognition capabilities applies to you. This article explains the migration process and provides key dates and links to additional resources.

Does this migration apply to me?

This migration applies to your tenant if you currently are using the following Z-Reports to manage revenue recognition:

- Deferred Revenue Recognition report

- Journal Entry report

- Transaction Detail report

What are the key dates that I need to be aware of?

Support and access to the Deferred Revenue Recognition, Journal Entry, and Transaction reports ended on these dates:

- February 1, 2015: Technical support for these reports ended

- June 1, 2015: Access to these reports ended

What additional resources are available to help?

We have created several resources to help make this migration seamless:

- Watch our webinar Getting Started with Revenue Recognition to learn all the details and about how easily you can transition to the new solution.

- Take our free Revenue Recognition online training from Zuora University. Enter the code:

revrecto self-sign in. - Review Revenue Recognition articles in the Knowledge Center.

How does the new Revenue Recognition replace Reporting Revenue reports?

| If you Are Using | Replace With | New Capabilities |

|---|---|---|

| Deferred Revenue Recognition | Revenue Detail Export | Revenue Recognition |

| Transaction Detail | ||

| Journal Entry | Summary Journal Entries Data Source Export | Summary Journal Entries |

How does the migration work?

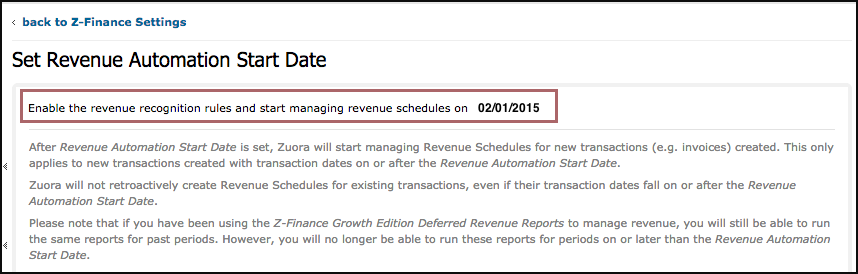

The switch to the new Revenue Recognition process is as easy as selecting a Revenue Automation Start Date. The following is an example of a Revenue Automation Start date set on February 1, 2015, the start of an accounting period.

The Revenue Recognition package will handle revenue from the time you turn it on. For revenue generated before the Revenue Automation Start Date, you have a couple of options. You can:

- Continue to manage these revenue streams separately through your prior processes.

- Manually create revenue schedules for transactions dated before your Revenue Automation Start Date. We recommend this option, because you will be able to get a more complete picture of your revenue all inside Zuora. See Create Revenue Schedules for Existing Transactions for more information.

This migration does not automatically move revenue data that was created prior to the Automation Start to the new Revenue Recognition process.

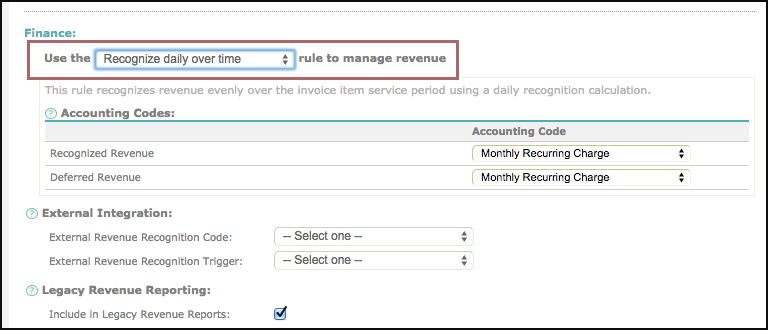

Once you turn on the new Revenue Recognition, Zuora automatically creates rules that model your existing revenue recognition reporting.

The following billing-based rules will be available as part of the migration:

- Recognition Daily Over Time, applied by default to your product rate plan charges.

- Recognition Upon Invoicing

In the Finance section of your product rate plan charges, note that the Recognize daily over time rule to manage revenue is selected by default.

Review Getting Started with Revenue Recognition for a high-level overview of the revenue recognition process. Keep in mind that for this migration, not all steps apply.

Migrate to the new Revenue Recognition

Switching to new Revenue Recognition capabilities is a smooth process. You set the Revenue Recognition Automation Start Date and Zuora auto-creates revenue recognition rules that match the exact logic used in the Deferred Revenue report.

Steps to Migrate

- Request access to Revenue Recognition capabilities. Contact Zuora Global Support for help. You will have access to new Revenue Recognition capabilities from the Zuora Sandbox and Production environments.

- Set the Recognition Automation Start Date. Setting this date triggers the automatic, rule-driven management of revenue. When you are ready to start Revenue Recognition in Zuora's production environment, the migration is a smooth experience. Keep the following in mind about the Recognition Automation Start Date:

- The date must be on the start date of an open accounting period.

- The date cannot be changed once set.

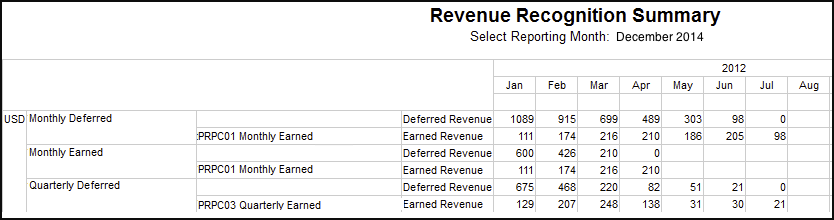

How does the new Revenue Recognition compare to the Deferred Revenue Report?

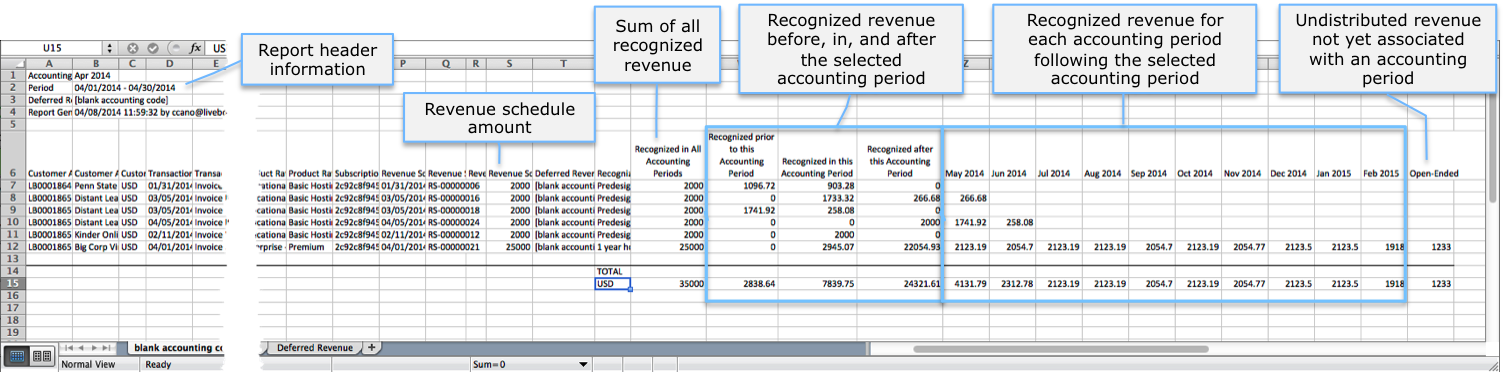

Once you have made the switch to the new Revenue Recognition, here's how you can get the same information – only better – from our new revenue recognition capabilities.

The Deferred Revenue Report organizes information by currency, accounting code, type, and revenue account.

The new revenue recognition, Accounting Period Revenue Detail report, provides you with the same information as the deferred revenue report - plus additional detail. See Accounting Period Revenue Detail for a complete description and steps on how to export this report.

(Click the image for a larger view)