How do I handle overpayments when customers pay more than they owe?

Overview

An overpayment occurs when a customer account in Zuora provides payment for more than the total remaining balance of all posted invoices. This is common when the customer payment method type is an external payment method, such as check or wire transfer, and accidentally submits full payment for their account balance twice. The amount the customer has overpaid is considered the overpayment amount.

Solution

There are three approaches to handling an overpayment:

- Use a credit balance adjustment to apply the overpayment as a payment to subsequent invoices.

- Use a negative invoice charge to apply the overpayment as a credit to a future invoice.

- Return funds to the customer and do not record any credit balance or negative invoice credit in Zuora.

Zuora recommends that you use credit balance adjustment to apply overpayment to subsequent invoices because they minimize overhead for processing funds, and also use best practices functionality.

Because credit balance adjustment functionality is not supported by NetSuite, you must either use a negative invoice charge or return funds to the customer if you are using Z-Suite.

Example: Using Credit Balance Adjustment to Apply an Overpayment to a Subsequent Invoice

Apply overpayment as a payment to subsequent invoices, using a credit balance adjustment.

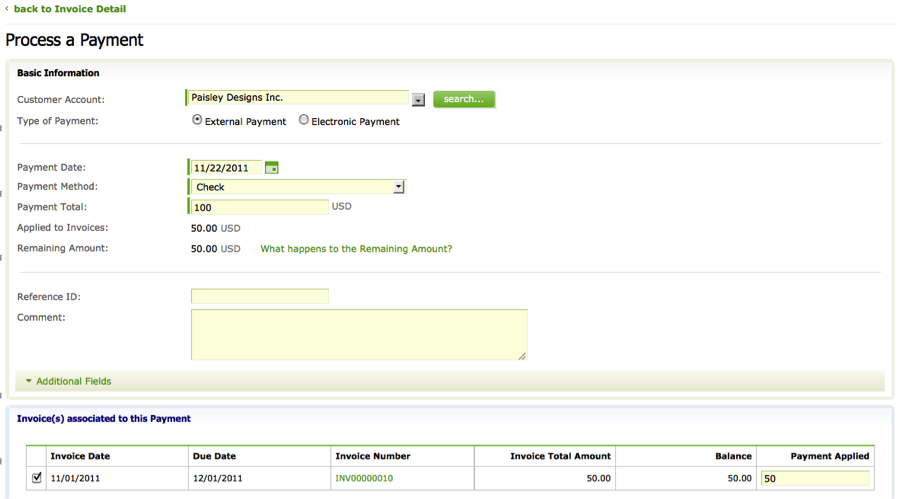

Customer submits two payments of $50 ($100 total) by check, for a $50 invoice. The amount overpaid by the customer is $50. To apply the $50 overpayment as a payment to a subsequent invoice, you can create a credit balance adjustment by first creating a payment. Specify the Type of Payment as External Payment Method, and select a valid Payment Method (for example, check).

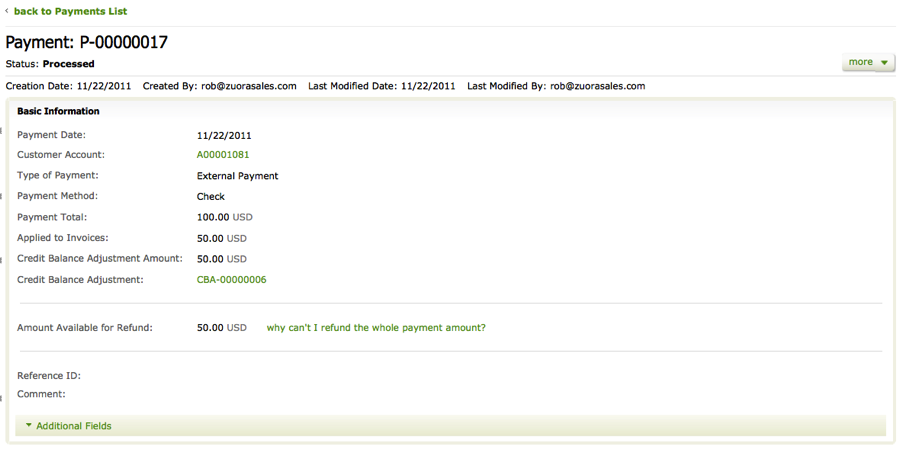

After you submit the page by clicking Create Payment, you will receive a confirmation dialog that confirms that you will create a $50 credit balance adjustment. The following image the payment (displayed when you submit the page in the previous image), which also shows a newly created credit balance adjustment (CBA-00000006):

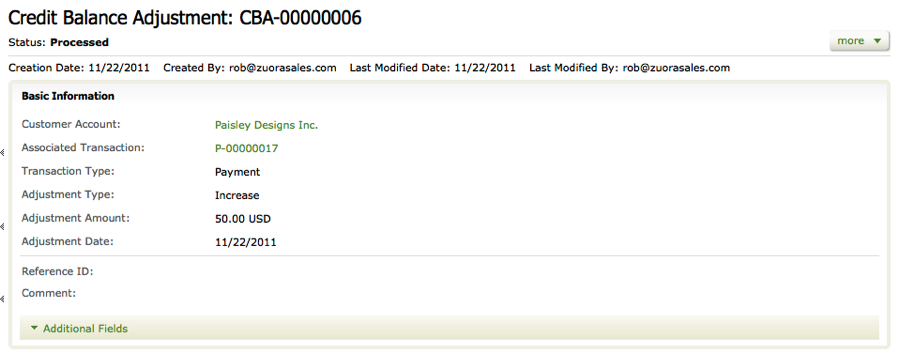

This image shows the newly created credit balance adjustment:

To apply the credit adjustment to a subsequent invoice, you can either:

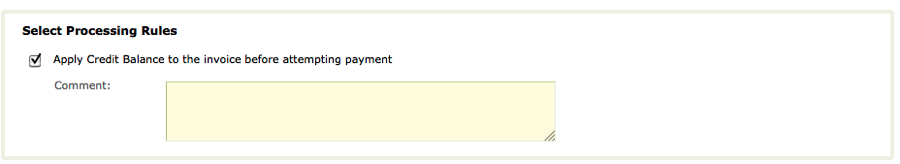

- If customer default payment method is an electronic payment method (for example, Credit Card, ACH, PayPal, Debit Card), you can process a payment run and select the option to Apply Credit Balance to the invoice before attempting payment (see screenshot below). This will apply the credit balance adjustment amount as a payment for the invoice. If the Invoice amount is less than the credit balance adjustment amount, the remaining amount will remain as a credit balance adjustment on the account. The following image shows the Bill Run set up page that offers the option:

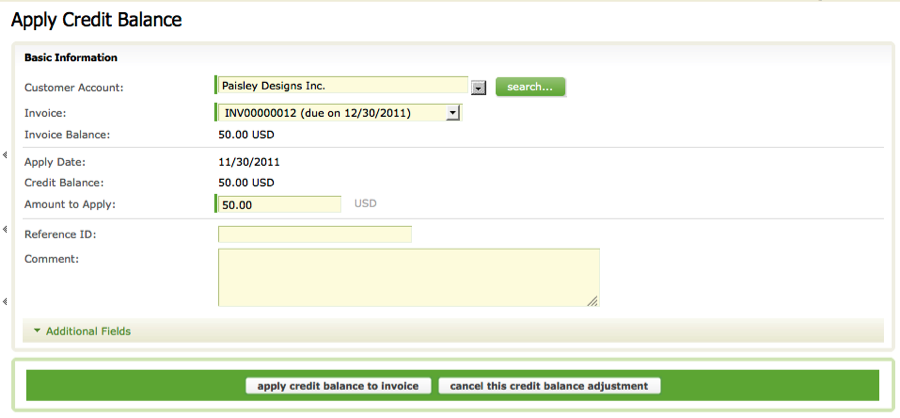

- If the default payment method for the account is an external payment method (for example, check), you can manually apply the credit balance to an invoice by navigating to the Account page, scrolling down to the Transactions section, selecting the Credit Balance tab, selecting Apply Credit Balance, and submitting the completed page. The following image is an example of a completed Credit Balance page:

Example: Using a Negative Invoice Charge to Apply the Overpayment as a Credit to a Future Invoice

To apply an overpayment received from a customer as a credit to a future invoice, you can create a product rate plan in the Zuora product catalog that includes a one-time charge with a negative default amount.

To add the rate plan with the negative one-time charge to the subscription, use an Add Product amendment, specify the appropriate amount to credit the customer as a one-time negative charge, and set the appropriate Contract Effective date (Service Activation, Customer Acceptance) to trigger the one-time charge. You must make sure that the negative one-time charge amount is less than or equal to the total amount of the next invoice for the account. You can use the Subscription Preview feature to determine this.

Process a bill run for the account to generate the one-time negative charge, with the subsequent invoice charges. This will render a consolidated invoice, which reduces the subsequent invoice by the amount of the negative one-time charge.

Example: Returning Funds to the Customer and not Recording any Credit Balance or Negative Invoice Credit

For this option, you only need to return the amount overpaid to the customer. Because no overpayment is recorded in Zuora, there are no additional steps required in Zuora.

This is not a preferred method, because it increases your organization's overhead to return funds, and possibly adds transaction costs (for example, direct mail costs or wire transfer fees).