How do I manage credit card payment exception handling process?

Overview

The vast majority of credit card payments are successful. However, payments do fail and its important to build a process around failed payments to ensure you maximize your revenue from collections.

Payments fail for a variety of reasons such as insufficient funds, account is closed, or a timeout with the processor. Zuora's best practice is to proactively manage payment methods to reduce payment exceptions. Some steps in managing payment methods include using the Zuora payment method updater to update the credit card information or actively use the Zuora notification engine to send emails to your customers when their cards are near its expiration dates. This proactive approach significantly reduces the scope of the payment exception process.

The solution below discusses some important Zuora features you can utilize in implementing a payment exception process that gives you flexibility where you want it, but is still be extremely simple to manage.

Solution

Timing of Payment Runs

Zuora's payment runs can be configured to run as regularly as you want. Often customers will configure the payment run to execute at 10 AM and 4 PM daily, but it is important to understand the frequency of payments. For best results, you will want to time the payment run so that it completes approximately an hour before your settlement cutoff time. Often this the settlement cutoff time is 7 PM PST, however, it's best to check with your payment provider for the exact settlement cutoff time.

Define Your Retry Rules

Now that you have payment runs configured, you can define your payment run retry rules. Every customer and scenario is different, but our best practice is the following:

- Maximum Number of Retries = 3 (but often can be 5 or 7)

- Retry Interval = 23. This means that the payment will not be retried within 23 hours of the last failed payment. Depending on your payment failures, we have seen customers set a larger window of 3 or 5 days and that works for them.

It is always best to update and tune these parameters as needed. You should also define what you want to do when a payment method has reached its maximum number retries. Every customer has different workflow, for example, some will shut down the service while others will email the customer.

Action Required When Maximum Number of Retries is Reached

The consecutive failed payments is a counter that is stored on the payment method and you can query this for payment methods that have reached the maximum number of retries in order to perform amendments or notifications as needed.

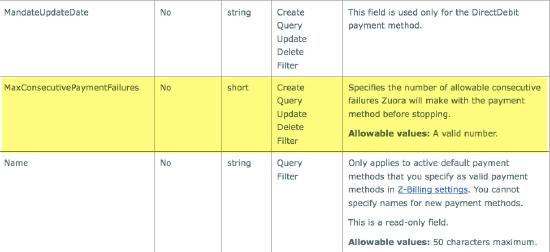

In the API, you can query for the field: MaxConsecutivePaymentFailures.

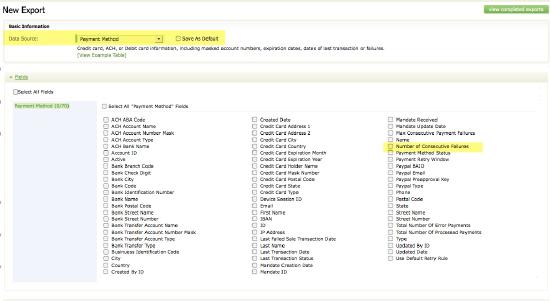

In the user interface, you can pull a data sources or Zuora Standard or Custom Report in payment methods with the field: Number of Consecutive Failures.

The great thing about the payment retry rules is that it can run in the background and when the customer updates their payment method (for example, to add a new expiration date) or when there is a successful payment, we reset the consecutive failed payment counter so the process can be started again when there is a failed payment.

As an optional service, Zuora also partners with Verifi to provide advanced decline salvage functionality where they will manage payments that have reached the max and use their proprietary logic to create a payment.

Customer Notifications

Zuora's notification engine can be configured to send an emails to alert the customer:

- When their payment methods are about to expire so they can update the payment method or provide an alternative payment method.

- When a payment fails to alert them that there was an issue with the payment method and to submit a new payment method if needed.

See Notifications and Callouts to read more about the email and call out notifications.