Components and Configuration Options

The following components comprise a revenue rule model and its associated rules:

- Basic information

- Recognition term

- Recognition rules (exception handling)

Each revenue rule model has its own default set of components and logic that is specific to the model. You can create a new rule from a revenue rule model to configure rules specific to your recognition policies. See Manage Revenue Rules for more information.

The following table summarizes your configuration options for each rule model:

| Component | Daily recognition over time | Full recognition on a specific date | Full recognition upon invoicing | Monthly recognition over time | Manual Recognition | Custom Unlimited Recognition |

|---|---|---|---|---|---|---|

| Basic Information |  |

|

|

|

|

|

| Recognition Term |  |

|

|

|

|

|

| Recognition Rules (Exception Handling) | ||||||

| Distribution |  |

|

|

|

|

|

| Rounding |  |

|

|

|

|

|

| Transaction Date |  |

|

|

|

|

|

| Closed Accounting Periods |  |

|

|

|

|

|

To view the Zuora-defined options that comprise a rule model, click your username at the top right and navigate to Finance Settings > Manage Revenue Recognition Rules and open the rule.

Basic Information

Applies to: All revenue rule models

Basic Information about the revenue rule includes:

- Name: The name for the rule.

- Recognition Model: The name of the revenue rule model on which the rule is created.

- Active: Select this check box to activate this rule for use.

- Description.

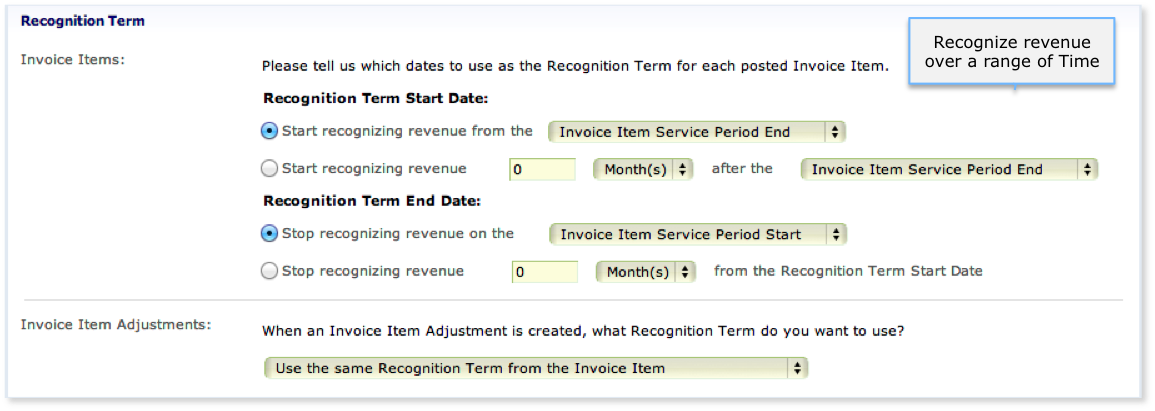

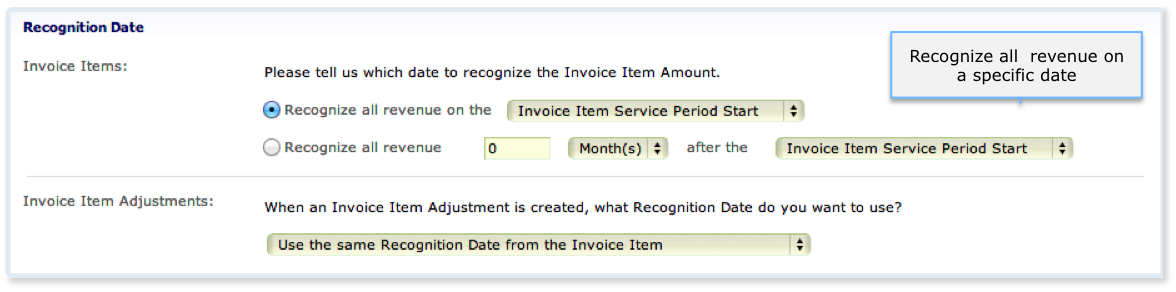

Recognition Term

Applies to: Daily recognition over time, Full recognition on a specific date, Monthly recognition over time

Invoice items

For the Daily recognition over time rule or the Monthly recognition over time rule:

You can define when to start and stop recognizing revenue by configuring one of the following options:

- Time period, such as Invoice Item Service Period Start and Invoice Item Service Period End.

- Number of years, months, days after the time period. For example, start recognizing revenue 10 days after the Invoice Item Service Period Start and stop 10 days after the Recognition Term Start date.

For the Full recognition on a specific date rule, you can configure the time period or number of years, months, days after the time period in which to recognize revenue. All revenue is recognized on that date.

When configuring the recognition term by number of years, months, or days, the maximum number allowed for each is:

- Years: 20

- Months: 120

- Days: 5,000

How the Recognition Term Start and End Dates are Calculated

Calculating the Term Start Date

Applies to: Daily recognition over time, Full recognition on a specific date, Monthly recognition over time

The calculation for the recognition term start date:

[selected time period date] + [# of years or months or days] = Recognition Term Start Date

Calculating the recognition term start date using number of years or days is straightforward. For months, the calculation considers the varying number of days in a month and leap years. For example, If the Invoice Item Service Period Start date is December 31 and revenue recognition starts one month after that date, the recognition term start date is January 31. If the period start date is October 31 and revenue recognition starts one month later, the recognition term start date is November 30.

Calculating recognition term End Date

Applies to: Daily recognition over time, Monthly recognition over time

The calculation for the recognition term end date:

[recognition term start date] + [# of days] = Recognition Term End Date

OR

[recognition term start date] + [# of years or months] - 1 = Recognition Term End Date

For example, if the Recognition Term Start date is March 31 and revenue recognition stops one month after that date, the recognition term end date is April 29. If the term start date is April 30 and revenue recognition stops one month later, the recognition term end date is May 29.

For example, suppose that you want to know what the recognition term and start dates for your subscriptions charge are based on the following criteria:

- Daily Recognition over time rule

- Recognition term starts 30 days, 1 month, or 1 year after the Subscription End Date

- Recognition term ends 30 days, 1 month, or 1 year after the Recognition Term Start Date

The following table shows the resulting term start and end dates:

| Subscription End Date | # of Periods After Subscription End Date |

Recognition Term Start Date | # of Periods After Recognition Term Start Date |

Recognition Term End Date |

|---|---|---|---|---|

| January 31, 2011 | 30 Days | March 2, 2011 | 30 Days | April 1, 2011 |

| 1 Month | February 28, 2011 | 1 Month | March 27, 2011 | |

| 1 Year | January 31, 2012 | 1 Year | January 30, 2013 | |

| February 29, 2012 (leap year) |

30 Days | March 30, 2012 | 30 Days | April 29, 2012 |

| 1 Month | March 31, 2012 | 1 Month | April 29, 2012 | |

| 1 Year | February 28, 2013 | 1 Year | February 27, 2014 | |

| March 10, 2013 | 30 Days | April 9, 2013 | 30 Days | May 8, 2013 |

| 1 Month | April 10, 2013 | 1 Month | May 9. 2013 | |

| 1 Year | March 10, 2014 | 1 Year | April 9. 2014 |

Invoice Item Adjustment

For Invoice Item Adjustments, you can use the same recognition term dates as the invoice item settings. You can also configure a term start and stop date specific to invoice item adjustments.

Note that Invoice Item Adjustment will not be available if you enable the Invoice Settlement feature.

To configure a term start and end date, the following options are available:

- Use the Invoice Item Adjustment Service Period

- Use the same Recognition Term from the Invoice Item (default)

- Define separate Recognition Term.

- Don't define a Recognition Term. Let me manually distribute revenue.

If you define a separate recognition term for invoice item adjustments, the options are the same as invoice items:

- Time period, such as Invoice Item Service Period Start and Invoice Item Service Period End.

- Number of years, months, days after a specific time period. For example, start recognizing revenue 10 days after the Invoice Item Service Period Start and stop 10 days after the Recognition Term Start date.

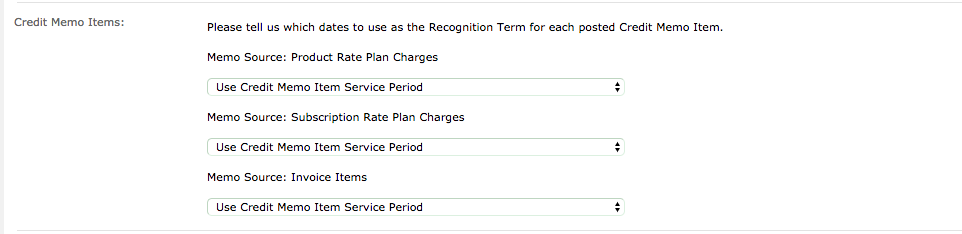

Credit Memo Items

Credit Memo Items is only available if you enable the Invoice Settlement feature.

The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant.

For the Daily recognition over time rule or the Monthly recognition over time rule:

You can select which options to use as the Recognition Term for the credit memo items:

- Product Rate Plan Charges

- Use Credit Memo Item Service Period

- Define Separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

- Subscription Rate Plan Charges

- Use Credit Memo Item Service Period

- Define separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

- Invoice Items

- Use Credit Memo Item Service Period

- Use the same Recognition Term from the Invoice Item

- Define separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

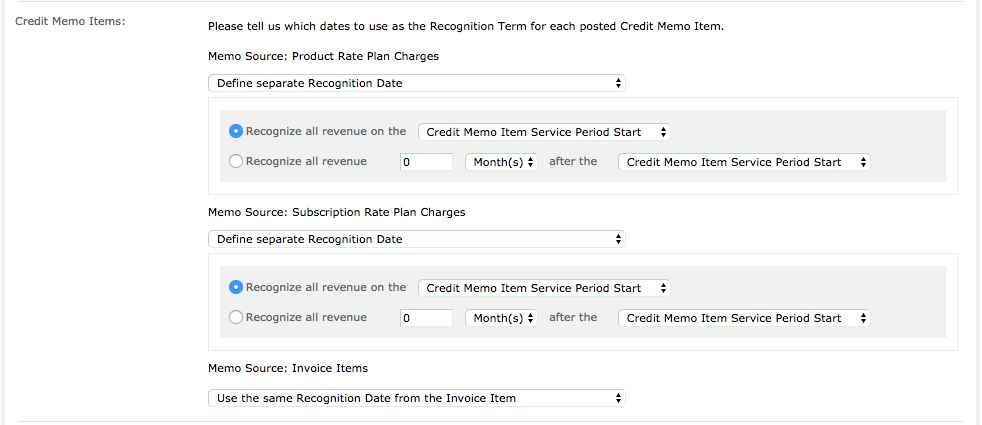

For the Full recognition on a specific date rule:

You can select which options to use as the Recognition Term for the credit memo items:

- Product Rate Plan Charges

- Define Separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

- Subscription Rate Plan Charges

- Define separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

- Invoice Items

- Use the same Recognition Term from the Invoice Item

- Define separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

Define Separate Recognition Term

You can define when to start and stop recognizing revenue by configuring one of the following options:

- Time period, such as Credit Memo Item Service Period Start and Credit Memo Item Service Period End.

- Number of years, months, days after the time period. For example, start recognizing revenue 10 days after the Credit Memo Item Service Period Start and stop 10 days after the Recognition Term Start date.

Debit Memo Items

Debit Memo Items is only available if you enable the Invoice Settlement feature.

The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant.

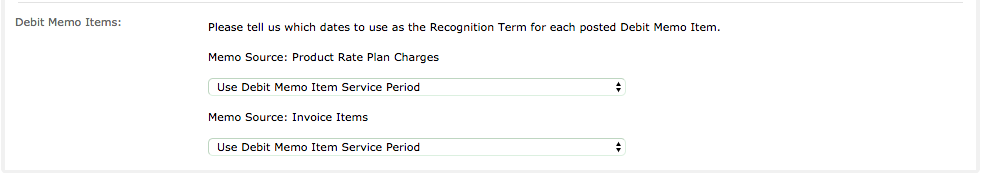

For the Daily recognition over time rule or the Monthly recognition over time rule:

You can select which options to use as the Recognition Term for the debit memo items:

- Product Rate Plan Charges

- Use Debit Memo Item Service Period

- Define Separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

- Invoice Items

- Use Debit Memo Item Service Period

- Use the same Recognition Term from the Invoice Item

- Define separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

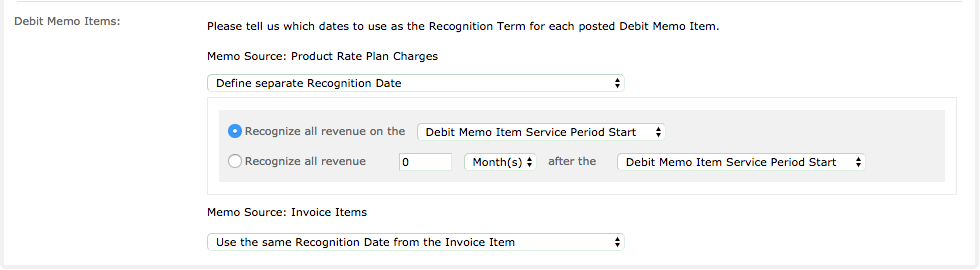

For the Full recognition on a specific date rule:

You can select which options to use as the Recognition Term for the debit memo items:

- Product Rate Plan Charges

- Define Separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

- Invoice Items

- Use the same Recognition Term from the Invoice Item

- Define separate Recognition Term

- Don't define the Recognition Term. Let me manually distribute the revenue

Define Separate Recognition Term

You can define when to start and stop recognizing revenue by configuring one of the following options:

- Time period, such as Debit Memo Item Service Period Start and Debit Memo Item Service Period End.

- Number of years, months, days after the time period. For example, start recognizing revenue 10 days after the Debit Memo Item Service Period Start and stop 10 days after the Recognition Term Start date.

Recognition Rules

The Recognition Rules component of a revenue rule model defines how to handle the following revenue recognition exceptions:

- Distribution

- Rounding

- Transaction date

- Closed accounting periods

Distribution

Applies to: Daily and monthly recognition over time

Distribution determines how to distribute the daily and monthly revenue amount when a partial month occurs at the start and/or end of the recognition term.

The following are the distribution options:

- Front load: Front load the revenue so you distribute the monthly amount in the partial month at the beginning only.

- Back load: Back load the revenue so you distribute the monthly amount in the partial month at the end only.

- Proration by days: Use the number of days to split the revenue amount between the two partial months.

Monthly distribution example

The following examples show how each option distributes revenue for partial months:

Scenario 1

- Service period: January 15 to April 14 of the same year

- Invoice item amount: $300

The following table compares the proration of a Front Load and Back Load distribution:

| Month | Front Load | Back Load | Number of Proration Days | Prorated Amount |

|---|---|---|---|---|

| January 15 - January 31 (partial month) | $100.00 | $0.00 | 17 |

$54.74 |

| February | $100.00 | $100.00 | N/A | $100.00 |

| March | $100.00 | $100.00 | N/A | $100.00 |

| April 1 - April 14 (partial month) | $0.00 | $100.00 | 14 | $45.26 |

| Invoice Item Amount | $300.00 | $300.00 | N/A | $300.00 |

Proration is calculated as follows:

Number of prorated days:17 + 14 = 31 days

January proration:17 days * $100/31 days = $54.74

April proration:100 - January Proration which is, 100 - 54.74 = 45.26

Scenario 2

- Service period: October 31, 2023 to February 22, 2024

- Invoice item amount: $816.11

Distribution condition is as follows:

- Revenue recognition rule: Monthly recognition over time (the revenue schedule is generated while posting the invoice)

- Recognition term: Invoice item service period

- Recognition rules distribution: Front load

- Recognition rules rounding: Round trailing

Distribution is calculated as follows:

Amount per day: $816.11/115 days = $7.09

First period: October 31, 2023 to November 29, 2023

Last period: January 31, 2024 to February 28, 2024

Last partial covered days: 23 days

Amount for partial days: $7.09 * 23 days = $163.07

Bucket count: 3 (3 full months)

Remaining amount: Invoice item amount - Amount for partial days which is, $816.11 - $163.07 = $653.04

Amount for each remaining period: Remaining amount/Bucket count which is,$653.04/3 = $217.68

The following table shows the distribution amount for each accounting period:

|

Month |

Number of Proration Days |

Distribution Amount |

|---|---|---|

|

October, 2023 |

N/A |

$217.68 |

|

November, 2023 |

N/A |

$217.68 |

|

December, 2023 |

N/A |

$217.68 |

|

January, 2024 |

23 |

$163.07 |

Scenario 3

- Service period: January 04, 2023 to January 04, 2024

- Revenue amount: $100

- Revenue recognition rule: Recognize monthly over time

Distribution is calculated as follows:

Amount per day: $100/365 days = $0.27

Distribution amount for January 2023: $0.27 * 28 days = $7.56

Distribution amount for January 2024: $0.27 * 4 days = $1.08

Amount for partial days(January 2023 and January 2024): 100 - ($7.56 + $1.08) = $91.36

Amount for full 11 months(February 2023 to December 2023): $91.36 / 11 months = $8.30 (remainder excluded)

Remaining amount: $91.36 - ($8.3 * 11 months) = $0.06

Per the "Round Trailing" rule, $0.06 will be put as $0.01 from the last month to the front (from January 2024 to August 2023)

The following table shows the distribution amount for each accounting period:

|

Month |

Number of Proration Days |

Distribution Amount |

|---|---|---|

|

January 2023 |

28 |

$7.56 |

|

February 2023 to December 2023 |

N/A |

$8.30 / month |

|

January 2024 |

4 |

$1.08 |

Daily distribution example

The following example shows how each option distributes the revenue on daily basis:

- Service period: January 18, 2023 to February 17, 2023

- Invoice Amount: 455 JPY

Distribution condition is as follows:

Revenue recognition rule: Daily recognition over time

Recognition term: Invoice item service period

Recognition rules rounding: Round trailing

Distribution is calculated as follows:

Amount per day: 455 JPY / (14+17) days = 14.677419 JPY which is approximately, 14 JPY

First period: January 18, 2023 to January 31, 2023

Last period: February 01, 2023 to February 17, 2023

Distribution based on daily amount:

January 2023: 14 * 14 JPY = 196 JPY

February 2023: 17 * 14 JPY = 238 JPY

Remaining amount: 455 JPY - (196+238) JPY = 21 JPY

Per the "Round Trailing" rule, 21 JPY will be put as 1 JPY from the last month to the front (from January 28, 2023 to February 17, 2023)

The following table shows the distribution amount for each accounting period:

|

Month |

Distribution Amount |

|---|---|

|

January 2023 |

200 JPY |

|

February 2023 |

255 JPY |

Rounding

Applies to: Daily recognition over time, Monthly recognition over time

Rounding rules determine how to handle any remaining revenue amounts. The following options are available:

- Round trailing: Calculate the remaining revenue amount. Starting on the last day of the recognition period and working back in time, add $0.01 per day until the remaining amount is consumed.

- Round last: Calculate the remaining revenue amount. Add the remaining amount to the last day of the recognition term.

Suppose you have revenue of $135.33 that is recognized daily over a 90 day period, where the daily recognized revenue amount is $1.50 after rounding:

- Amount: $135.33

- Recognition term: 1/1/2013 through 3/31/2013 (90 days)

- Remaining amount: $0.33 =

$135.33 - [90 days * ( $135.33 / 90 days), rounded]

The following example shows how each rounding rule handles the remaining $0.33:

| Round Trailing Rule | Amount | Explanation |

|---|---|---|

| January Accounting Period | $0.00 | No remaining amount is available to add to this accounting period |

| February Accounting Period | $0.02 | $0.01 per day is added to the last two days of the accounting period |

| March Accounting Period | $0.31 | $0.01 per day is added to this accounting period, which is in this case is 31 days for the month of March. |

| Round Last Rule | Amount | Explanation |

|---|---|---|

| January Accounting Period | $0.00 | N/A |

| February Accounting Period | $0.00 | N/A |

| March Accounting Period | $0.33 | The whole remaining amount is added to the last day of the recognition term which falls in the Marching accounting period. |

Transaction Date

Applies to: Daily recognition over time, Full recognition on a specific date, Monthly recognition over time

You can define how to recognize revenue when the recognition term start date occurs before the transaction date.

For Daily recognition over time and Monthly recognition over time rules, the following options are available:

- Recognize revenue on the Transaction Date. Revenue that occurred after the recognition term start date, but before the transaction date, is recognized in the accounting period in which the transaction occurred.

- Ignore the Transaction Date. Ignore the transaction date and recognize revenue over the entire recognition term.

For the Full recognition on a specific date rule, the following options are available:

- Recognize all revenue on the Transaction Date Instead.

- Recognize revenue on the specified date regardless when the transaction occurred.

Suppose you have a revenue amount of $100 and want to know how the revenue is recognized based on this information:

- Revenue Rule: Daily recognition over time

- Transaction date: February 5

- Amount: $100

- Recognition term: January 1 to April 10

- Accounting periods: January, February, March, and April of the current year

This following shows how each Transaction Date rule distributes revenue into accounting periods:

| Transaction Date Rule Option | Explanation | January 1 - 31 |

February 1 - 28 |

March 1 - 31 |

April 1 - 10 |

|---|---|---|---|---|---|

| Don't recognize revenue before the transaction occurs | Recognize revenue on the transaction date.

Revenue of $31 that occurred in January is added to revenue amount recognized in February: |

$0 | $59 | $31 | $10 |

| Recognize revenue over the Recognition Term regardless when the transaction occurs | Ignore transaction date and recognize revenue over the term.

The transaction date is ignored and revenue is evenly distributed over the entire recognition term. |

$31 | $28 | $31 | $10 |

Closed Accounting Periods

Applies to: Daily recognition over time, Full recognition on a specific date, Full recognition upon invoicing, Monthly recognition over time

This option determines how to recognize revenue when the recognition term start date occurs in a closed accounting period. One option is currently supported.

Any new revenue that occurs in a closed accounting period is recognized in the next open accounting period.