Overview of long-term and short-term reclassification

In Zuora Revenue, when revenue is recognized for the Contract Liability account, there is a provision to reclassify the revenue to both the long-term and short-term accounts. This provisioning process is referred to as long-term and short-term reclassification (LT/ST Reclass) in Zuora Revenue. The main purpose of performing LT/ST reclassification is to reclassify the revenue to be recognized in both long term and short term to understand the revenue position of your organization.

Configuration overview

The LT/ST reclassification functionality in Zuora Revenue is driven by profiles and primarily works based on the specified profile values. Navigate to Setups > Application > Profiles and use the following profiles to configure the LT/ST reclassification functionality:

-

LT_ACCT_MONTHS

Use this profile to specify the number of months that are to be considered for the LT/ST reclassification process. For example, if this profile is set to 12, 12 months after the current open period will be considered as long-term periods. If the current open period is January 2019, the long-term periods will start from February 2020 until the revenue end date. -

LT/ST_PROCESS_FOR_RC_CA_STATUS

Use this profile to specify whether the revenue contract in CA position should participate in the LT/ST reclassification process. If this profile is set to Yes, LT/ST schedules can be booked for the revenue contract in CA position. Otherwise, the revenue contract in CA position will not participate in the LT/ST reclassification process.

In addition to profile configuration, for the LT/ST reclassification functionality to work, the following configurations are required in the system:

-

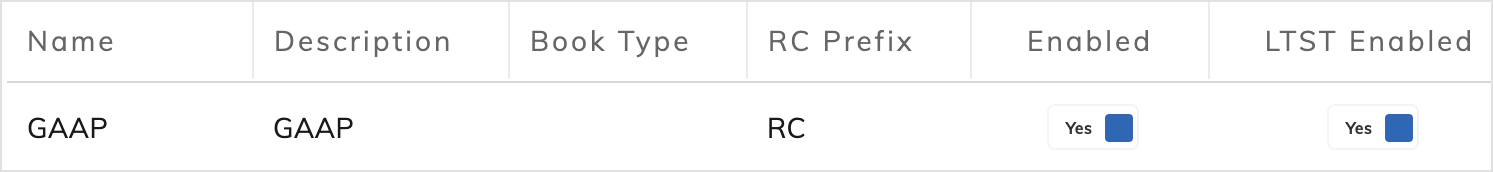

Setups > Application > Revenue Books

LT/ST reclassification is enabled for the revenue book. As shown in the following graphic, set the LTST Enabled column to Yes for the appropriate revenue book.

The LTST Enabled radio button must be configured to No if you do not wish to use the LT/ST process. From 37.014.00.00 release onwards, the system will automatically calculate the LT/ST if this radio button is enabled.

-

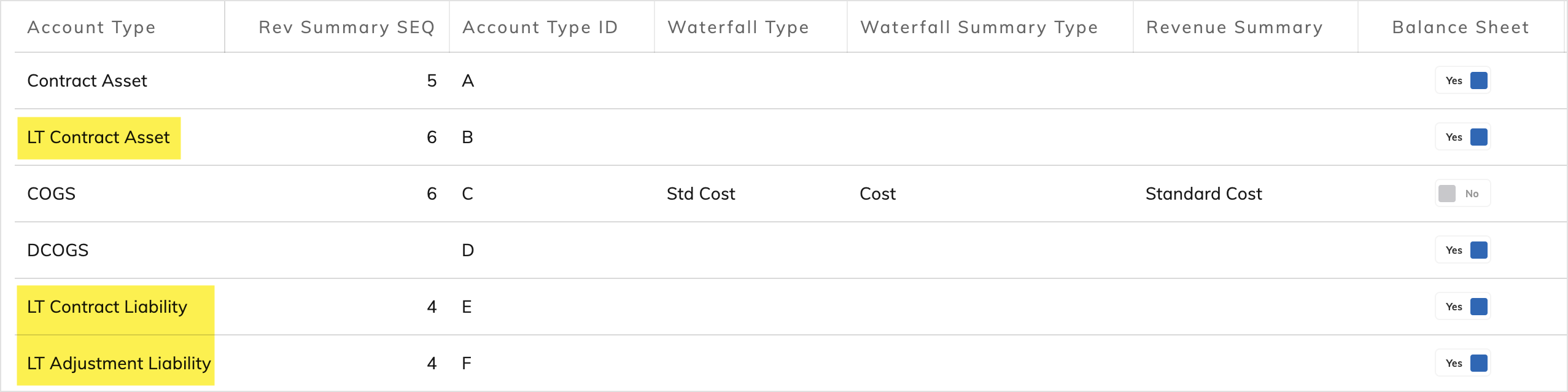

Setups > Application > Accounting Setup > Account Type

The long-term CL and long-term CA accounting types are defined in the system. The following graphic shows an example of the accounting setup.

-

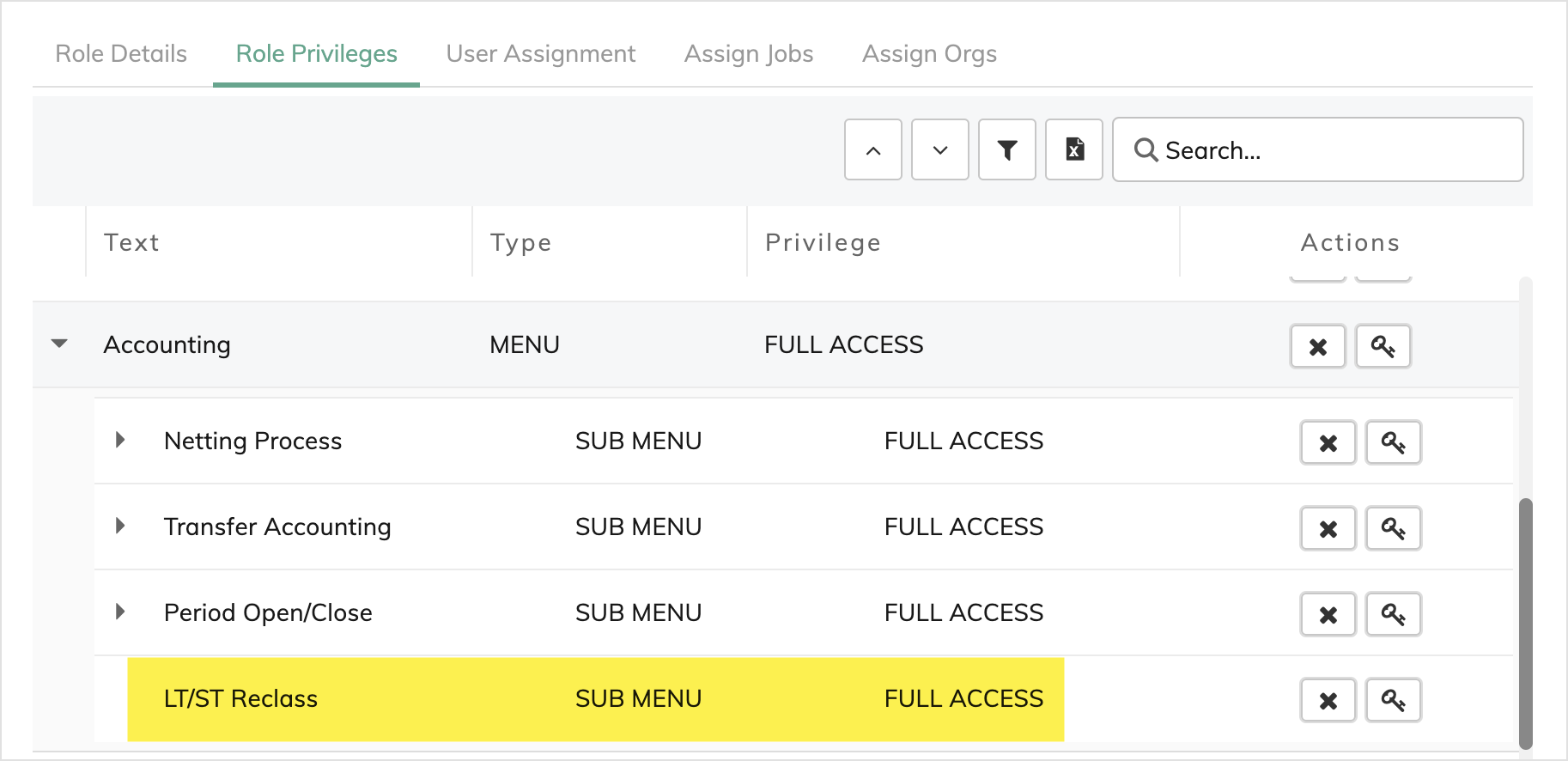

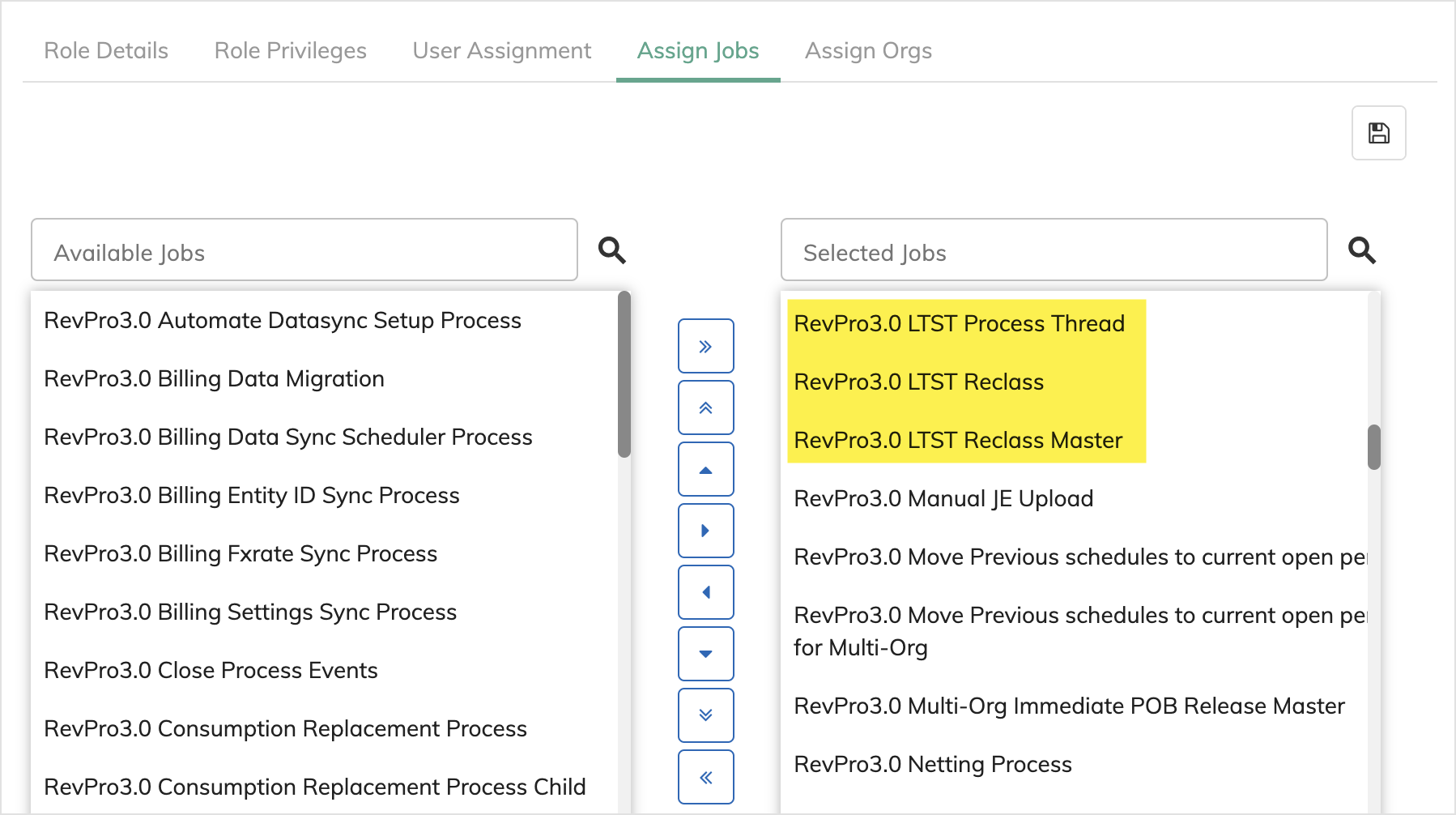

Setups > Security > Roles

In the Role Privileges tab, the role of the user who will start the RevPro3.0 LT/ST Reclass process has full access to the LT/ST Reclass sub-menu as shown in the following graphic.

In the Assign Jobs tab, the role of the user has access to the RevPro3.0 LT/ST Reclass jobs as shown in the following graphic.

Transaction input requirements

For LT/ST schedules to be created for eligible transaction lines, make sure the following fields are populated appropriately for the transaction lines that will participate in the LT/ST reclassification:

-

Company Code

-

SOB Id

Related articles

For information about how to start the reclassification process in the UI, see Start LT/ST reclassification process.

For information about the processing logic and examples, see LT/ST reclassification processing logic.