Assign accounting codes

- Last updated

- Save as PDF

For Zuora to provide you with revenue accounting data, you must assign accounting codes to various revenue transactions (invoices, payments, credits, refunds).

Before you begin, your chart of accounts must be configured for your business. See Set up chart of accounts for more information.

Use accounting codes in Zuora Billing

Financial transactions

You can use Zuora Billing as a simple revenue sub-ledger or a more full-featured revenue sub-ledger. Either way, every financial transaction in Zuora Billing must be associated with an accounting code that maps to the GL account affected by the transaction. The transactions which require an accounting code are:

- Invoices

- Invoice adjustments

- Invoice item adjustments

- Credit balance adjustments

- Payments (and credit balance payments)

- Refunds (and credit balance refunds)

- Credit and debit memos

- FX Gain/Loss

Credit balance payments and credit balance refunds can use their own separate codes or use the same codes as payments and refunds.

Add or change codes

If you don't use accounting codes, your transactions are recorded with a blank code. If you later start using accounting codes, new transactions created after the change will reflect the accounting codes, and old transactions will still have the blank code.

The same principle generally applies when making other changes as well:

- If you edit the codes you're using, transactions recorded before the edits will still have the old codes, and new transactions will have the new codes.

- If you change an accounting code assignment for a particular type of transaction, the change applies only to new transactions. For instance, if you assign a different accounting code to a product rate plan charge, any new invoices that you create will use the new accounting code. Existing invoices will not be affected by the change and will still have the old accounting code.

How accounting codes are derived and defined

The following chart summarizes where accounting codes are derived and defined in Zuora Billing. Detailed explanations are provided in the next section.

| Transaction | Where the Accounting Code is Derived From | Where to Define the Accounting Code in Zuora |

|---|---|---|

|

Invoice Item |

Rate Plan Charge |

|

|

Invoice Payment |

Payment Method |

|

|

Tax Item |

Tax Code |

Finance Settings > Configure Accounting Codes |

|

Credit Balance Payment |

Finance Settings: Configure Accounting Codes |

Finance Settings > Configure Accounting Codes |

|

Payment Refund |

Payment Method |

Finance Settings > Configure Accounting Codes |

|

Credit Balance Refund |

Finance Settings: Configure Accounting Codes |

Finance Settings > Configure Accounting Codes |

|

Credit Balance Adjustment |

Finance Settings: Configure Accounting Codes |

Finance Settings > Configure Accounting Codes |

|

Invoice Adjustment Note: Invoice Adjustment is deprecated on Production. Zuora recommends that you use the Invoice Item Adjustment instead. |

Invoice Adjustment Transaction |

When creating an Invoice Adjustment, go to Additional Fields > Accounting Code |

|

Invoice Item Adjustment |

Invoice Item: Rate Plan Charge |

|

|

The following transaction types are only available if you enable the Invoice Settlement feature. The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant. |

||

|

Credit Memo |

Finance Settings: Configure Accounting Codes | Finance Settings > Configure Accounting Codes |

| Debit Memo | Invoice Item: Rate Plan Charge |

|

Assign accounting codes for transaction types

This section discusses the best accounting codes to assign to various transaction types.

Invoice Items

For invoicing, the accounting code maps to an income or revenue GL account in your accounting system.

An invoice can include multiple items, such as subscription fees, support fees, and professional services fees. The GL account that you would associate with each of those items corresponds to the Zuora accounting code to assign at the product rate plan charge level. In Zuora, each invoice item will be tracked by the accounting code from the product rate plan charge.

You can use the same accounting code for any product rate plan charges that have the same revenue attributes. For example, subscriptions that contain quarterly billing schedules may have the same accounting codes as subscriptions that contain annual billing schedules.

Setting finance rules for rate plan charges

When creating a rate plan charge, select the revenue recognition rule that you want to use with the charge:

- Recognize upon invoicing: Select this rule so revenue will go straight against the Recognized Revenue accounting code – revenue is recognized all at once when the charge is invoiced.

- Recognize daily over time: Select this to include the charge in the Zuora Finance standard deferred revenue report, which recognizes revenue over a period of time using a daily recognition calculation. When closing an accounting period, Zuora will group all invoice items using the Deferred Revenue General Ledger account.

Using discount specific accounting codes and rules to manage revenue

When creating or editing a discount charge, select this option to define the finance information (including revenue recognition rules and accounting codes) for this discount charge. If you do not select this option, the discount charge uses finance information from the regular charge where the discount is applied.

Configuring accounting codes

Use the accounting codes to map to the GL accounts you use to create journal entries. Depending on how you choose to recognize revenue, you might need to enter either a recognized revenue account or both a recognized revenue account and a deferred revenue account.

If you have any existing accounting codes, we have automatically migrated them to the recognized revenue account. This has not changed any existing functionality of the accounting codes.

The accounting code represents the offsetting account to your accounts receivable (AR). We now automatically select accounting codes for you based on the revenue recognition rule that you have selected.

If you recognize revenue upon invoicing, we populate the accounting code with the value from the recognized revenue account. If you recognize revenue daily over time, we populate the accounting code with the value from the deferred revenue account.

Invoice Item Adjustments

The accounting code and accounting period for an invoice item adjustment automatically map to the same revenue GL account that was used for the original invoice item. If you have a direct integration with your accounting system, invoice item adjustments will reduce your corresponding accounts receivable balance. An invoice item adjustment can increase or decrease the invoice balance.

Invoice Payments

Accounting codes for invoice payments are defined under Finance > Configure Accounting Codes, and typically map to a bank account in your accounting system.

Credit Balance Payments

Accounting code for credit balances are defined under Finance > Configure Accounting Codes. A credit balance payment is created from an overpayment. The accounting code for a credit balance payment typically maps to a bank account in your accounting system and is generally different from the accounting code you would use for a normal payment.

Payment Refunds

Accounting codes for payments are defined under Finance > Configure Accounting Codes. The accounting code in a payment refund typically maps to a bank account in your accounting system. A refund also updates the accounts receivable in your GL. You then process an invoice item adjustment to the extent that the accounts receivable needs to be removed from your financial statements.

Credit Balance Refunds

Accounting codes for your credit balances are defined under Finance > Configure Accounting Codes. A credit balance refund occurs when you refund a credit balance payment. The accounting code for a credit balance refund is typically a bank account in your accounting system.

Credit Balance Adjustments (Increase)

The accounting code for a credit balance adjustment typically maps to a cash-on-account GL account in your accounting system. This transaction type is used when creating a credit balance from a negative invoice, which results in an increase to the credit balance amount on a customer account.

Credit Balance Adjustments (Decrease)

The accounting code for a credit balance adjustment typically maps to a cash-on-account GL account in your accounting system. This transaction type is used to transfer funds from the credit balance to a positive invoice, thus reducing the invoice balance.

Credit Memos

The Credit Memo transaction type is only available if you enable the Invoice Settlement feature.

The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant.

Accounting codes for your credit memos are defined under Finance > Configure Accounting Codes.

The accounting code for a credit memo that is applied to invoices inherits the Accounts Receivables from the invoice on the credit entry, and inherits the On-Account from the credit memo on the debit entry.

The accounting code for a credit memo that is applied to debit memos inherits the Accounts Receivables from the debit memo on the credit entry, and inherits the On-Account from the credit memo on the debit entry.

The accounting code for credit memo refunds inherits the Bank Account from the refund on the credit entry, and inherits the On-Account from the credit memo on the debit entry.

Debit Memos

The Debit Memo transaction type is only available if you enable the Invoice Settlement feature.

The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant.

The accounting code for debit memo automatically maps to the same revenue GL account that was used for the original invoice item. If you have a direct integration with your accounting system, debit memo items will reduce your corresponding accounts receivable balance.

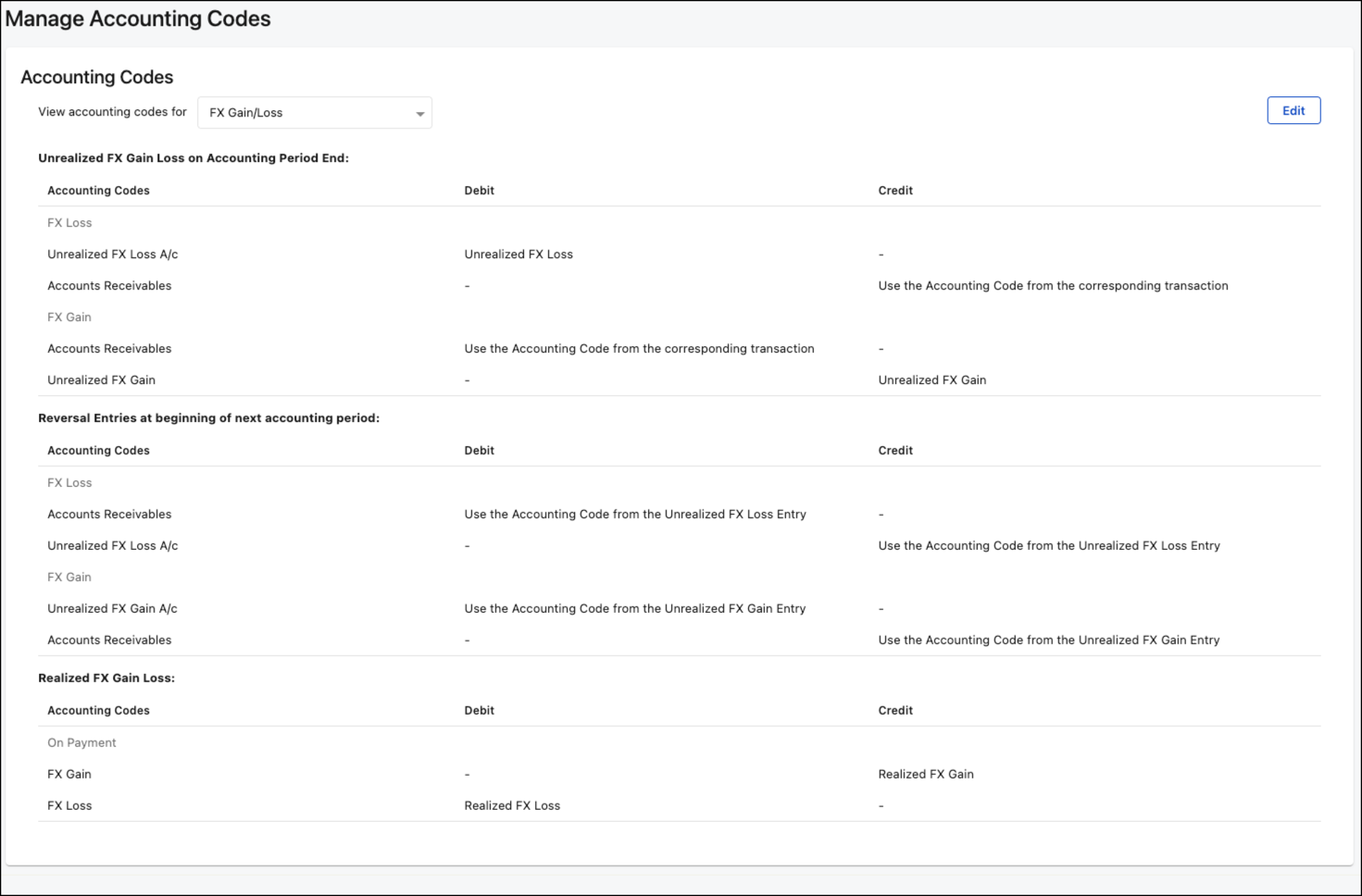

FX Gain/Loss

FX Gain/Loss transaction type is only available if you enable the FX Gain Loss GL Entries. For more information, see Create FX Gain Loss GL Entries.

The accounting code for FX Gain/Loss is applied to realized and unrealized FX gain loss on accounting period end and reversal entries.