How Amendments Impact Revenue Schedules

Overview

This article explains how amendments to subscriptions charges impact the distribution and revenue amount in revenue schedules.

How Amendments are Handled in a Revenue Schedule

The effect of an amendment is seen on revenue schedules after new invoices are generated and posted. In most cases, subscription changes are handled automatically and a new revenue schedule is created automatically, as well.

For example, a business signs the following contract for a cloud storage service:

- $12,000, 12-month contract starts September 1, 2013

- Invoiced quarterly for $3,000

- Revenue recognition rule model: Billing-based daily recognition over time

Suppose that the September 2013 and December 2013 invoices were generated for $3,000 each. In January 2014, the subscription was amended and the charge increased to $2,000 per month starting January 2014 – increase of $6,000 per quarterly invoice.

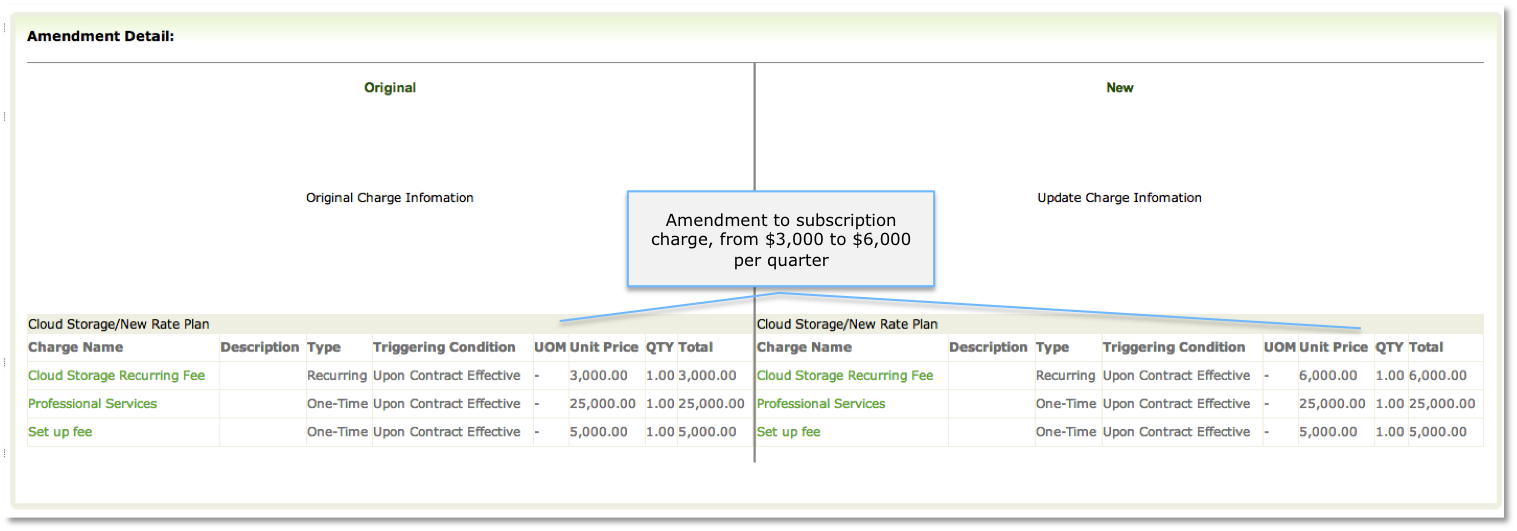

The following shows an example of an amended cloud storage recurring fee amended from $3,000 to $6,000.

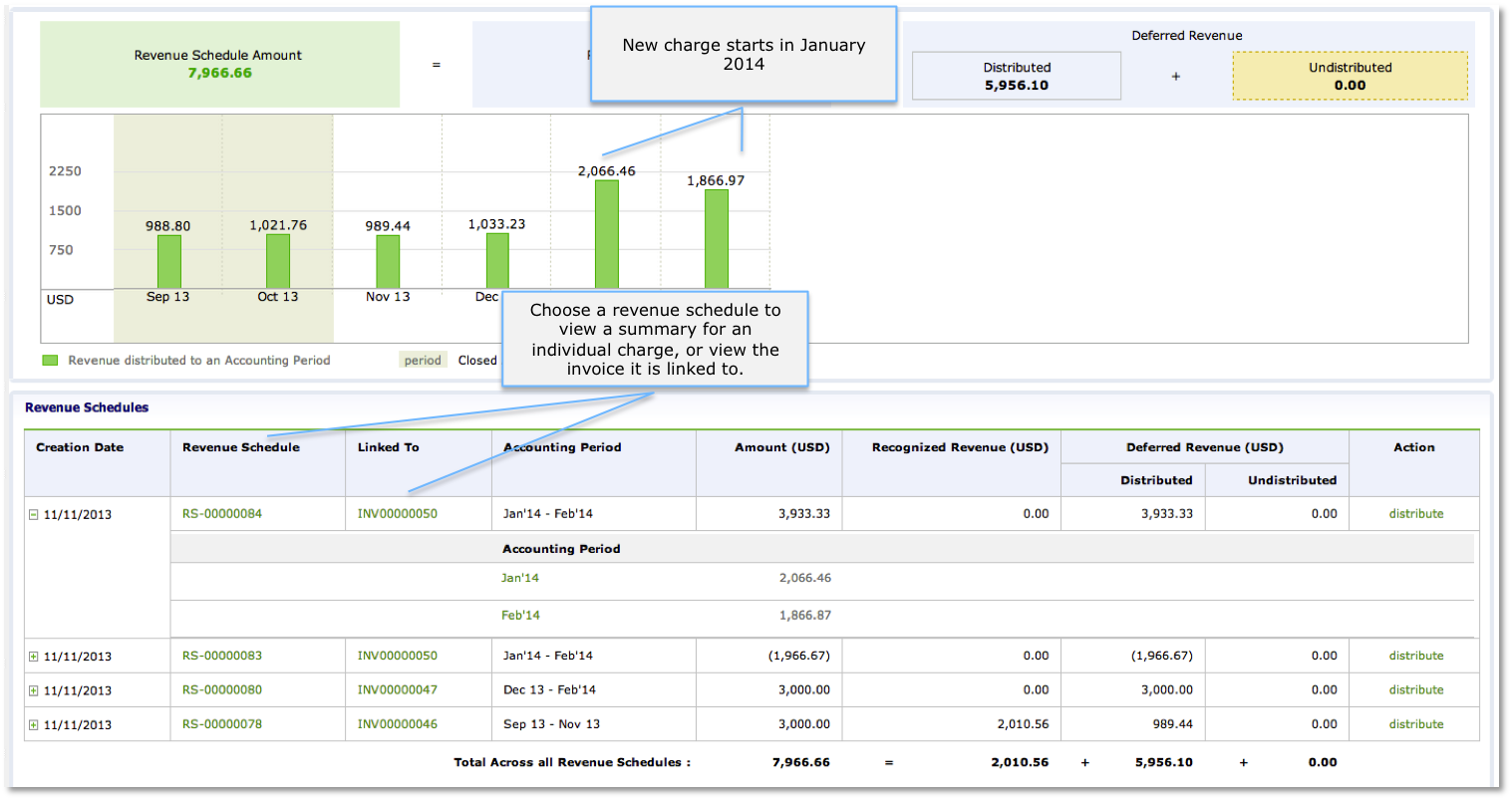

The following is an example of the charge revenue summary on the subscriptions. It shows how the amendment changes the revenue distribution starting in January 2014.

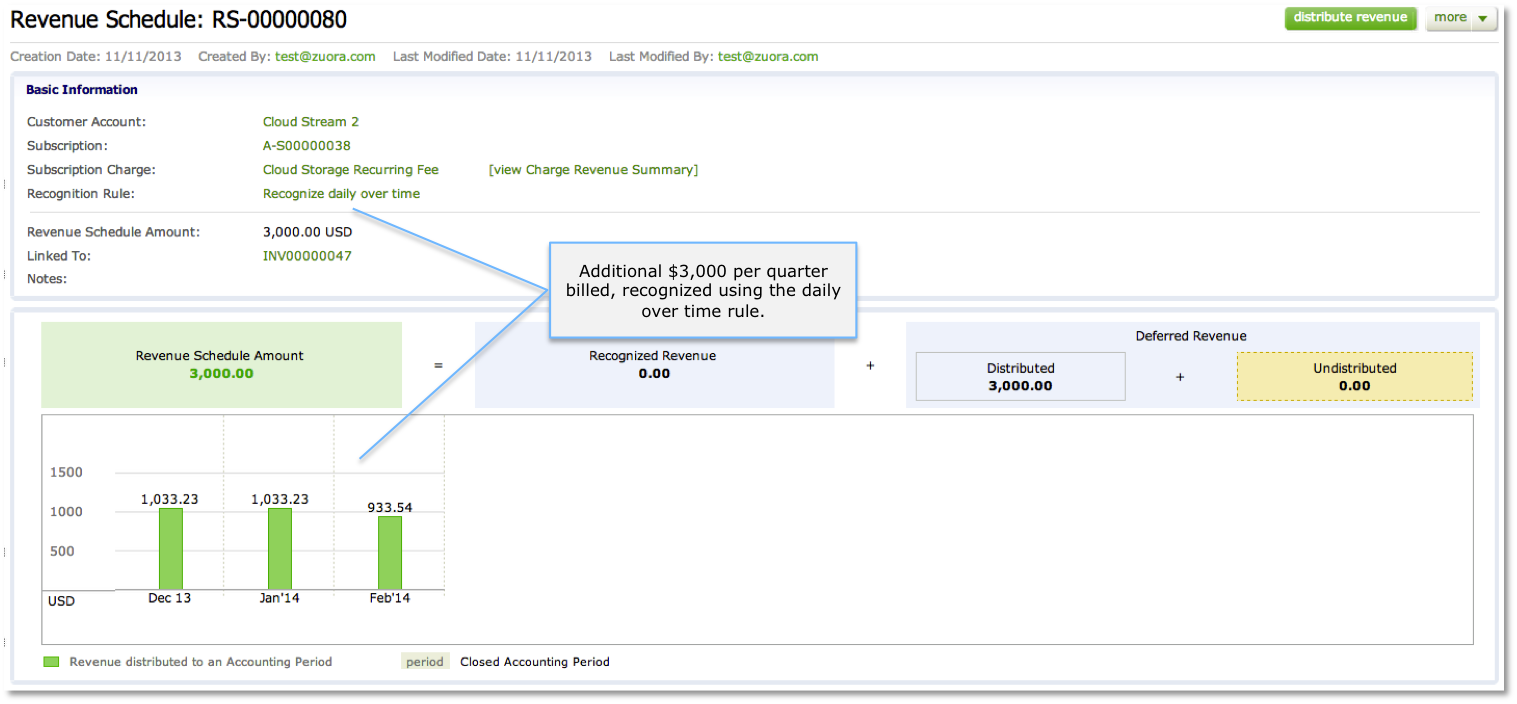

Click an individual revenue schedule to view detail on the amended charge. The revenue schedule associated with the amendment will show the additional $3,000 per quarter of revenue that was billed.