Revenue Schedules

Revenue schedules show the distribution of revenue into accounting periods and track when revenue is recognized. This article explains the basic concept of a revenue schedule. This article also explains how revenue schedules are created and how revenue is distributed.

What is a Revenue Schedule?

A revenue schedule represents how revenue amounts from a single charge are distributed over time and recognized in accounting periods. Revenue schedules maintain consistency with the currency used.

Basic Information

Basic information associated with the schedule. This includes the following:

- Customer account

- Subscription

- Subscription charge. Click view Charge Revenue Summary to access a distribution summary of all revenue schedules associated with the subscription charge. See Charge Revenue Summary for more information.

Note: A maximum of 3,000 revenue schedules can be created for a subscription charge. - Recognition rule

- Information specific to the revenue schedule, such as the date the schedule was created, the revenue schedule amount, the invoice, and any notes.

Revenue Schedule

Summary Information

- Revenue schedule amount: The total amount of revenue to be recognized and distributed into accounting periods. This amount is equal to the sum of recognized revenue plus the sum of distributed, unrecognized revenue and undistributed, unrecognized revenue.

- Recognized revenue: Revenue in accounting periods that are closed. Revenue is recognized immediately in Zuora when accounting periods are closed.

- Distributed unrecognized revenue: Revenue distributed into open accounting periods. Revenue categorized as distributed unrecognized can be modified.

- Undistributed unrecognized revenue: Any revenue not distributed into accounting periods is held in an undistributed, open-ended accounting period.

See the Revenue Distribution and Accounting Periods section later in this article for more information on open, closed, and open-ended accounting periods.

Revenue Distribution Chart

The revenue schedule shows how revenue is distributed across accounting periods.

- Revenue items: A revenue item shows the amount of revenue distributed into an accounting period. A green bar indicates a positive revenue amount and a red bar indicates a negative revenue amount, such as a credit adjustment.

- Accounting period: The accounting periods for the the term of the subscription. Revenue in an open accounting period is unrecognized. Revenue in a closed accounting period is recognized. A gray background indicates a closed accounting period.

Revenue Events

This section is an audit trail of the revenue events that cause a change to the revenue schedule. See Revenue Events for more information about revenue events and revenue event types.

- Date: When the revenue event occurred

- Revenue Event Type: The type of event, such as Invoice Created or Revenue Distributed

- Recognition Start and Recognition End: The recognition term for the revenue event

How Revenue Schedules are Created

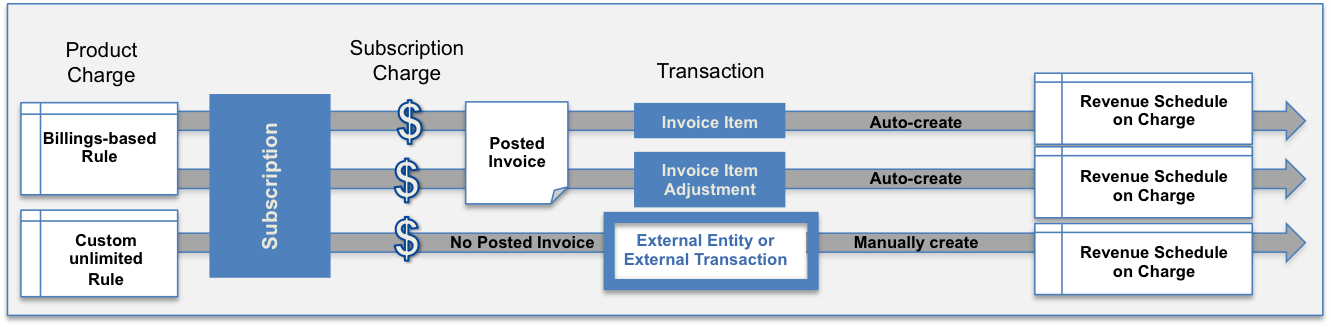

A revenue schedule is generated on a subscription charge for a specified service period. The following shows the process flow to auto-create or manually create a revenue schedule on a charge:

The following table summarizes key drivers for revenue schedules.

| Object | Summary | Rule | Posted Invoice | Transaction-driven | Auto-Created Revenue Schedule |

|---|---|---|---|---|---|

|

Invoice Item |

An auto-created revenue schedule has an indirect association with a subscription charge through the invoice item. An invoice item is the most common transaction type when creating revenue schedules. |

Any billing-based rule |

Required |

|

|

|

Invoice Item Adjustment |

An auto-created revenue schedule has an indirect association with a subscription charge through the invoice item adjustment, which is also tied to an invoice item. |

Any billing-based rule |

Required |

|

|

|

External Entity or Transaction |

A manually created revenue schedule has a direct association with a subscription charge, but no transaction occurs. When manually creating a revenue schedule, associate the external entity or transaction by defining a Transaction ID. |

Custom unlimited |

Not Required |

||

|

The following objects are only available if you enable the Invoice Settlement feature. The Invoice Settlement feature is generally available as of Zuora Billing Release 296 (March 2021). This feature includes Unapplied Payments, Credit and Debit Memos, and Invoice Item Settlement. If you want to have access to the feature, see Invoice Settlement Enablement and Checklist Guide for more information. After Invoice Settlement is enabled, the Invoice Item Adjustment feature will be deprecated for your tenant. |

|||||

| Credit Memo Item |

An auto-created revenue schedule has an indirect association with a subscription charge through the credit memo item. |

Any billing-based rule Custom unlimited |

N/A |

Required |

|

| Debit Memo Item |

An auto-created revenue schedule has an indirect association with a subscription charge through the debit item. |

Any billing-based rule Custom unlimited |

N/A |

Required |

|

For manually creating revenue schedules for subscription charges, see Manually Create Revenue Schedules for Subscription Charges.

For manually creating revenue schedules for invoice items and invoice item adjustments, see Create Revenue Schedules for Existing Transactions.

Taxation Support

Currently, revenue schedules are not supported for taxation on invoice items and invoice item adjustments.

Subscription Amendment

A subscription amendment is indirectly tied to a revenue schedule. The effect of a subscription amendment appears on revenue schedules after new invoices are generated and posted. In most cases, subscription changes are handled automatically. See How Amendments Impact Revenue Schedules for an example.

Revenue Distribution and Accounting Periods

Revenue distribution is the core driver behind a revenue schedule. Revenue is scheduled for distribution based on the rule applied to a product rate plan charge and on the dates and durations of your accounting periods.

Revenue is distributed into accounting periods. Zuora recommends creating at least five years of accounting periods. The maximum number of accounting periods that you can distribute revenue into is 250 months (approximately 20 years).

The following accounting period statuses determine if a revenue amount can be distributed into an accounting period:

- Closed: Revenue cannot be distributed in a closed accounting period.

- Open: Revenue can be distributed and distribution can be modified.

Open-Ended Accounting Period

The Open-Ended accounting period is a container for all undistributed revenue. The start date of the Open-Ended accounting period is always the day after the end date of the most recent accounting period. Revenue is placed into the Open-Ended accounting period in the following scenarios:

- A revenue schedule is created that uses the Manual Recognition rule or a Custom Unlimited recognition rule. You must manually distribute the revenue.

- A revenue schedule is created that uses an automated recognition rule, but you have not yet created the accounting period into which the revenue is to be distributed. When you have created the accounting period, you can distribute revenue from the Open-Ended accounting period into the newly-created accounting period with a single action.

Revenue Amounts Held in the Open-ended Period

Any remaining revenue held in the open-ended period must be distributed at some point into open accounting periods.

If you are manually distributing revenue, the revenue schedule amount must equal the sum of the distributed revenue amounts in accounting periods. Once you create a revenue schedule, you cannot change the revenue schedule amount. Before you save the revenue schedule, check for the following:

- If the sum of the distributed revenue is less than the revenue schedule amount, the remaining balance remains in the open-ended accounting period.

- If the sum of the distributed revenue amount is greater than the revenue schedule amount, a negative revenue amount remains in the open-ended accounting period. If you want to adjust the amount, create another revenue schedule with a positive or negative amount that you want to modify.

- If accounting periods are not created for the recognition term, the remaining revenue is automatically held in an open-ended accounting period. For example, you have a one-year recognition term, but only have accounting periods for six months. The remaining six months of revenue is held in an open-ended accounting period.

Revenue Items and Zero Revenue Amounts

A revenue item is created to track a revenue amount change in an accounting period. Zero revenue amounts are handled differently depending on how the revenue schedule is created:

- For auto-created revenue schedules: A revenue item is always created – even when a zero revenue amount occurs in the accounting period. This can occur under the following circumstances when the revenue schedule amount is:

- A zero dollar amount.

- A very small, such as a fraction of a dollar amount, and is rounded down to zero after revenue is distributed into the accounting periods. For example, if the revenue schedule amount is $0.05 and distributed into 12 accounting periods – equaling less than $0.005 – a fraction of a penny – revenue reported in each accounting periods is rounded down to a zero dollar amount.

- For manually created revenue schedules: A revenue item is not created when a zero revenue amount occurs in an accounting period.

Performance metrics calculation

Revenue Schedule generation is an automatically triggered, asynchronized backend process at the time the billing transaction is originated.

The time interval of revenue schedule and billing transaction = Number of transactions pending for revenue schedule generation/revenue schedule generation throughput.

For customers who use shared message queue and backend server with other customers, the pending message in queue include all the pending transaction messages including other customers.

The average revenue schedule generation throughput is 650 / min.

For example,

- A customer created 10,000 invoices in a bill run, and each invoice has two items.

- Average Revenue Schedule Processing Throughput = 650 / min.

- There are 5,000 pending transactions in the queue before the bill run is created.

so,

To generate all the revenue schedule for the invoices in the bill run, the time taken will be as follows:

5,000 + 10,000 / 650 = 23 minutes

Notes

- The average throughput is based on the assumption that at least 1 to 2 items are in the invoices/memos. The throughput will be lower for the invoices with a large volume of items.

- The performance metrics are based on basic AWS hardware configuration. Better hardware can further improve performance.