Upload exchange rates to Zuora Revenue

Exchange rate conversion is supported for the following reports. After you upload exchange rates to Zuora Revenue, the system can derive the reporting currency fields based on the uploaded exchange rates for these reports.

- Revenue Insight

- Waterfall Report

- RC Rollforward Report

- Unsatisfied POB Balances

- Revenue Summary

- Billing RollForward Report

- Trial Balance Report

Prerequisites

Before you start uploading the exchange rate, make sure the following requirements are met:

- Ensure that the required report layout is configured to add the reporting currency fields. For more information about how to edit the report layout, see Edit layout.

- Enable the exchange rate conversion in the system. To do this, navigate to Setups > Applications > Profiles and set the ENABLE_SOURCE_R_EX_RATE profile to Yes.

Procedure

Complete the following steps to upload the exchange rate to Zuora Revenue:

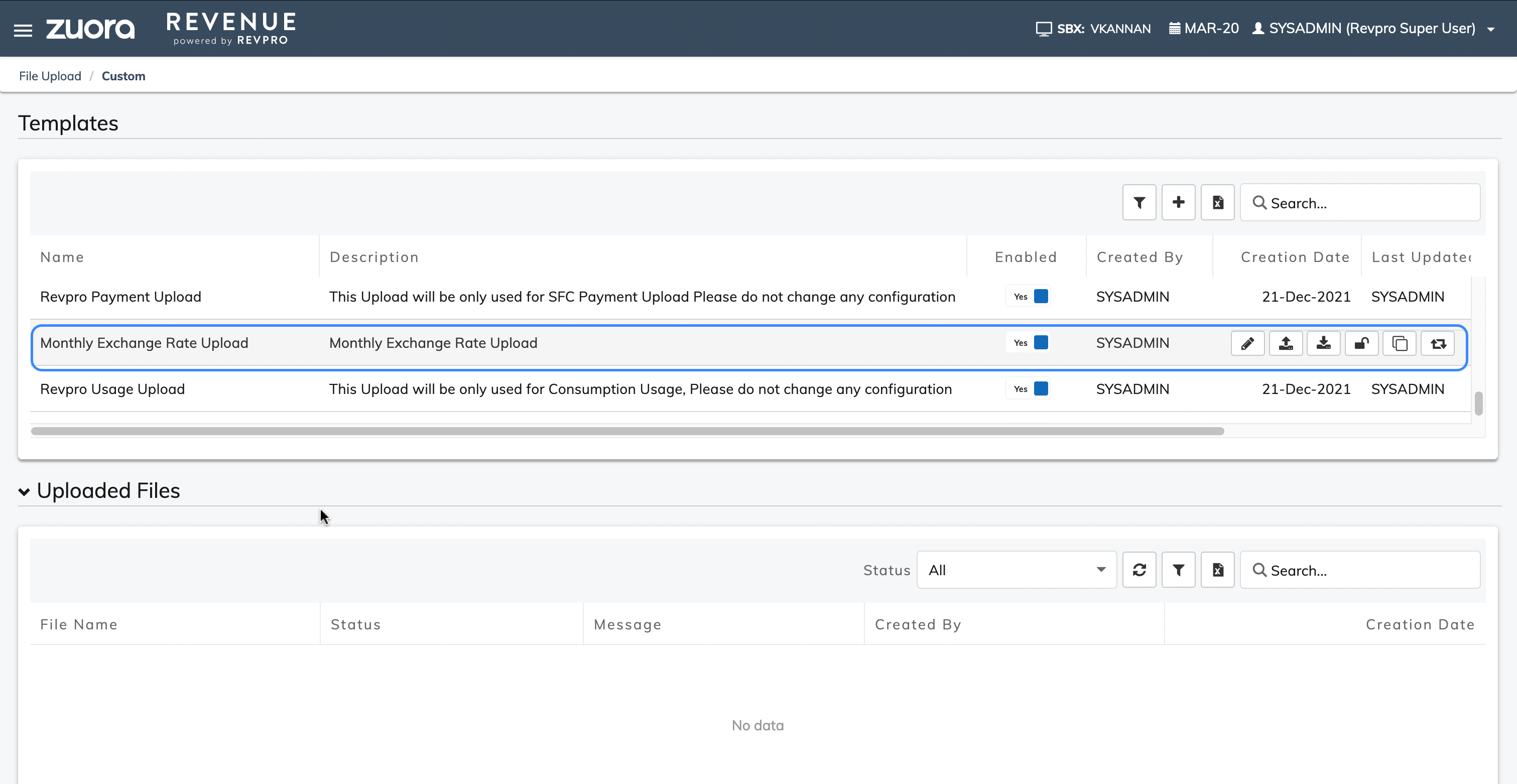

-

Navigate to File Upload > Custom.

- To download and update the exchange rate template, complete the following steps:

- Hover your mouse over the Monthly Exchange Rate Upload template line and click the Download Template icon

to download the template file.

- Open the template file, and fill in the following information:

- From Currency

- Enter the appropriate functional currency. All functional currencies should have been already created and uploaded in Zuora Revenue.

- To Currency

- Use this field to enter a currency type from the already uploaded functional currencies in the system. If the reporting currency is updated as USD in the system, then To Currency must be updated as USD.

- Start Date

- Specify the start date of the month.

- End Date

- Specify the end date of the month.

- Exchange Rate

- Specify the exchange rate that is used to convert the home currency into the transaction currency for the set duration.

- Exchange Rate Type

- Specify the exchange rate type. The valid values include Period Average and Period End. Period End rates are used for the balance sheet account, and Period Average rates are used for the Profit/Loss accounts.

- The start date and end date must be set according to the calendar setup. Zuora Revenue will use the calendar's end date every month to determine the respective exchange rate from the uploaded exchange rates.

- Ensure that all field details that you enter in the upload file contain no typos because the system will not do any no validation against the input. If erroneous data are in the uploaded file, the system cannot derive the reporting currency fields correctly.

- Ensure that there are no duplicate entries in the same file. Duplicate entries refer to the entries with the same From Currency, To Currency, Start Date, End Date, and Exchange Rate Type values. When duplicate entries exist, the system will randomly select the exchange rate to use.

- This CSV file is provided as an example for your reference.

- Save your changes in the file. The exchange rate template file is updated.

- Hover your mouse over the Monthly Exchange Rate Upload template line and click the Download Template icon

-

To upload the exchange rate template file to the list, complete the following steps:

-

Hover your mouse over the Monthly Exchange Rate Upload template line and click the Upload icon

.

-

Choose the local file that you just updated and then click Upload.

-

In the Uploaded Files section on the Custom page, you can view the file upload result.

Note: Trial Balance contains the following fields that represent account balance:

| Fields | Description |

|---|---|

| F.Amount(H) | Use exchange rates from the transactions that come from the respective orders and billings. |

| R.Amount(H) | |

| T.Amount(H) | |

| R. Amount - Curr Period Rt | These fields are available only for global currency RCs. This will display a blank value if multi-currency is used. If current period rates are required, you must have customizations to populate the respective rates into Zuora Revenue every month through a custom job. Rates should be inserted into rpro_ex_rates_g every month. |

| F. Amount - Curr Period Rt |

What to do next

After the exchange rates are successfully uploaded, you can run the supported reports based on the layout configured with the reporting currency fields. For general instructions, see Run reports.

- Every month, all the functional currency and its reporting currency conversion exchange rate(only incremental) must be manually uploaded to Zuora Revenue. Otherwise, the system cannot derive the reporting currency fields for the supported reports.

- If any correction is needed, you can re-upload the exchange rates at any time. Zuora Revenue will automatically use the latest data available for the respective month.

Limitations

Be aware of the following limitations when you enable exchange rate conversion for the supported reports:

- Exchange rate conversion is not applicable when the Aggregate Flag is enabled in the layout for RC Rollforward, Revenue Insight, and Waterfall reports.

-

The following reporting currency fields are calculated based on the reporting currency from the transactional tables, which are not applicable to using the uploaded reporting currency exchange rates. These fields will still display the original amount in Reporting currency.

- Invoice Amount (R)

- Ext Sell Price (R)

- Ext List Price (R)

- Billed - Unreleased Revenue (R)

- Ext SSP Price (R)

- Unreleased Revenue (R)

- Released Revenue (R)

- Billed - Released Revenue (R)